How Much Of My Credit Card Should I Use

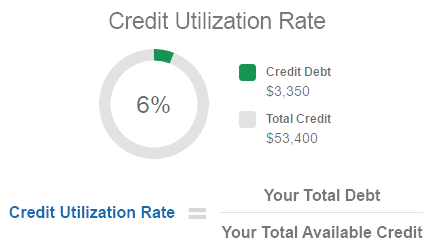

If you have a 1000 limit on your credit card and youre carrying a 700 balance at the statement closing date youre using 70 of your available credit. A big misconception around credit cards is that you should carry some debt from month to month in order to display good credit.

So if you have a 900 limit on one credit card and spend 450 during one billing cycle your credit utilization ratio on that card would be 50 percent.

How much of my credit card should i use. Our Experts Found the Best Credit Card Offers for You. Using it to pay any one of the three card balances or dividing it across two or all three would reduce your total utilization to 28but putting the full 300 toward Card 1 will do that and lower the utilization on that card from 38 to 32a change that will tend to improve your credit score. Anyone can figure out that its difficult to keep below spending 300 a month with such a low limit.

My choice was the Discover it. Your average balances across all your cards for the past 24 months should represent no more than 10 of your overall credit limit Ulzheimer says. Some credit card issuers will close your credit card account if it goes unused for a certain period of months.

Experts generally recommend maintaining a credit utilization rate below 30 with some suggesting that you should aim for a single-digit utilization rate under 10 to get the best credit score. Its not going to. But if you have a 1000 limit and a credit card balance of 200 your utilization is only 20 which is.

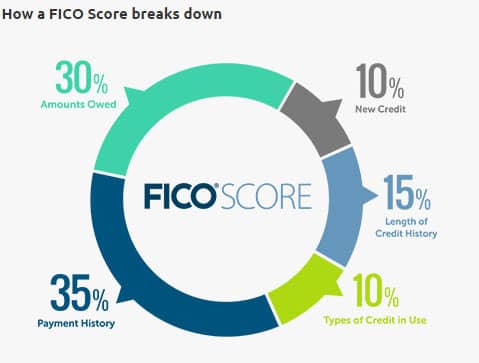

Just spend whatever you want up to 300. At its core this is all about how much of your overall available credit you are using which makes up 30 of your FICO score. You may have heard experts recommend keeping your credit utilization rate below 30 but two credit gurus CNBC Select spoke to say it should be much lower than that if you want a good credit.

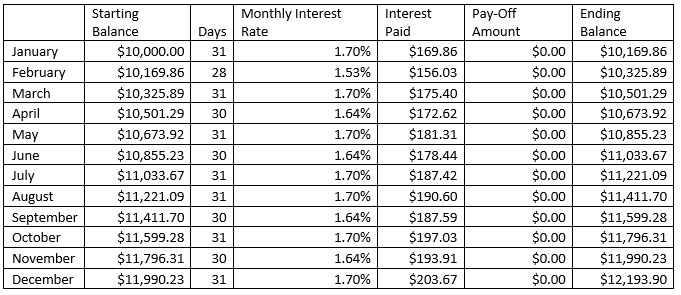

Otherwise make at least a minimum payment. High credit utilization usually comes from keeping debt on your card as well as piling on more purchases each month. But theres really no magical utilization rate cutoff for every scoring model.

Your credit card limit is 300. Ad Get a Card with 0 APR Until 2022. Thats not a good look to creditors.

But if your 2000-limit card were closed due to inactivity that would bring your utilization up to 50 percent. Best Credit Cards for Fair Credit. Once you pay your credit card.

Falsewhen your credit card statement arrives pay it off in full. Theres no definitive rule for how often you need to use your credit card in order to build credit. In this case your credit utilization would be nearly 17 percent 5003000.

Ad Get a Card with 0 APR Until 2022. When it comes to paying off your credit card try to pay the most you can. The specifics depend on the credit card issuer but the range is generally between 12 and 24 months.

Our Experts Found the Best Credit Card Offers for You. Its commonly said that you should aim to use less than 30 of your available credit and thats a good rule to follow. The first involves one of the most important aspects of your credit score.

Your amounts owed frequently referred to as your utilization rate. Having a lower credit utilization rate implies that you are not likely to default on your credit payments. In general it is recommended that you use up to 20 of your credit limit.

There are a few things hell want to consider. Starting out your first credit card should be a no-annual-fee card that pays cash back rewards on everything you buy.

How Paying A Credit Card Statements Work Credit Card Insider

How Paying A Credit Card Statements Work Credit Card Insider

How Closing A Credit Card Account For Inactivity Will Affect Your Score

How Closing A Credit Card Account For Inactivity Will Affect Your Score

How Do I Get A Higher Limit On My Credit Card Nerdwallet

How Do I Get A Higher Limit On My Credit Card Nerdwallet

Study How Much Will Paying Off Credit Cards Improve Score Badcredit Org

Study How Much Will Paying Off Credit Cards Improve Score Badcredit Org

How Much Of My Credit Limit Should I Use Us News

How Much Of My Credit Limit Should I Use Us News

What Is A Credit Utilization Rate Experian

What Is A Credit Utilization Rate Experian

How To Pick The Best Credit Card For You 4 Easy Steps Nerdwallet

How To Pick The Best Credit Card For You 4 Easy Steps Nerdwallet

How Much Should I Pay Back On My Credit Card Each Month Armstrong Advisory Group

How Much Should I Pay Back On My Credit Card Each Month Armstrong Advisory Group

How Paying A Credit Card Statements Work Credit Card Insider

How Paying A Credit Card Statements Work Credit Card Insider

Credit Card Minimum Payment Calculator

Credit Card Minimum Payment Calculator

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png) The Difference Between Credit Card And A Debit Card

The Difference Between Credit Card And A Debit Card

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Comments

Post a Comment