Can You Deduct Medicare Premiums

You can deduct your Medicare premiums and other medical expenses from your taxes. If you itemize your deductions on the 1040 form when you file your taxes you might be able to deduct your Medicare Advantage premiums.

Medicare Costs Will Rise Slightly In 2021 But Beware Of Irmaa Seeking Alpha

Medicare Costs Will Rise Slightly In 2021 But Beware Of Irmaa Seeking Alpha

You may be able to include them as an itemized deduction on your Schedule A instead.

Can you deduct medicare premiums. Yes your monthly Medicare Part B premiums are tax-deductible. This includes medical and dental expenses as well. Thats followed by the self-employed health insurance deduction and the itemized deduction in that order.

In addition to Medicare premiums you can deduct various medical expenses including those for dental treatment ambulance services dentures eyeglasses and contacts hospital services lab tests qualified long-term care services prescription medicines and others. The rules for deduction depend on your specific circumstances including your income and employment status. So if you deducted.

If you itemize deductions you may be able to deduct healthcare costs such as Medicare premiums. However the IRS does have certain criteria which could qualify you or disqualify you from claiming those medical and dental premiums. Medical expense deduction basics.

Medicare premiums are allowed to be deducted from your Itemized Schedule A Form 1040 federal tax return. You can deduct your premiums even if youre not self-employed. If they along with your other medical costs exceed 75 of your Adjusted Gross Income AGI you qualify for the deduction.

Medical expense deduction basics. If youre on a fixed income every dollar countsincluding money spent on health care and Medicare premiums. Are My Medicare Premiums Tax Deductible.

According to the Internal Revenue Service IRS you may be able to deduct insurance premiums including your Medicare Advantage premium from your taxes if you itemize your deductions on the 1040 form. These costs will be taken as above-the-line deductions which means they will lower your AGI. Deducting Medicare as a Business Expense.

Medicare Part A premiums arent deductible if youre covered under Social Security or if youre a government employee who paid Medicare tax. This requires you to itemize the premiums. You can only deduct amounts that are.

In order to get a tax deduction for your Medicare Advantage premium or Medicare Part B premium you must itemize your tax deductions. Your income possible deductions and other circumstances can also affect which Medicare premiums youre able to deduct. In general you can deduct.

In addition to Medicare premiums you can deduct various medical expenses including those for dental treatment ambulance services dentures eyeglasses and contacts hospital services lab tests qualified long-term care services prescription medicines and others. Itemized deductions do not reduce your AGI. There are three main ways in which you might be able to deduct your Medicare premiums.

Medical expense deduction basics In addition to Medicare premiums you can deduct various medical expenses including those for dental treatment ambulance services dentures eyeglasses and contacts hospital services lab tests qualified long-term care services prescription medicines and others. Your Medicare and Medigap premiums can be deducted from your taxes as a below the line deduction. But the self-employed health insurance deduction isnt the only way to deduct your Medicare premiums.

The IRS says that you can deduct certain medical and dental expenses for yourself if you itemize deductions on Schedule A Form 1040. Medical expense deduction basics. You can deduct premiums you pay for any part of Medicare including Medigap.

The first the business deduction is the most financially advantageous. Insurance premiums are among the many items that qualify for the medical expense deduction. Medical expense deduction basics In addition to Medicare premiums you can deduct various medical expenses including those for dental treatment ambulance services dentures eyeglasses and contacts hospital services lab tests qualified long-term care services prescription medicines and others.

In addition to Medicare premiums you can deduct various medical expenses including those for dental treatment ambulance services dentures eyeglasses and contacts hospital services lab tests qualified long-term care services prescription medicines and others. Since its not mandatory to enroll in Part B you can be rewarded with a tax break for choosing to. However if you arent covered under Social Security nor a government employee who paid Medicare tax and you voluntarily enrolled in Medicare A you can deduct those premiums.

You will be able to deduct all Medicare premiums from your federal taxes for you andor your spouse along with Medigap plan premiums premiums from Medicare Advantage plans and Part D prescription drug plan premiums. If your medical premiums are deducted through a payroll deduction plan its more than likely that youre covering your share of your insurance premium with pre-tax dollars.

Deducting Medicare Advantage Premiums From Your Taxes

Deducting Medicare Advantage Premiums From Your Taxes

Can You Deduct Medicare Premiums Phoenix Tucson Az

Can You Deduct Medicare Premiums Phoenix Tucson Az

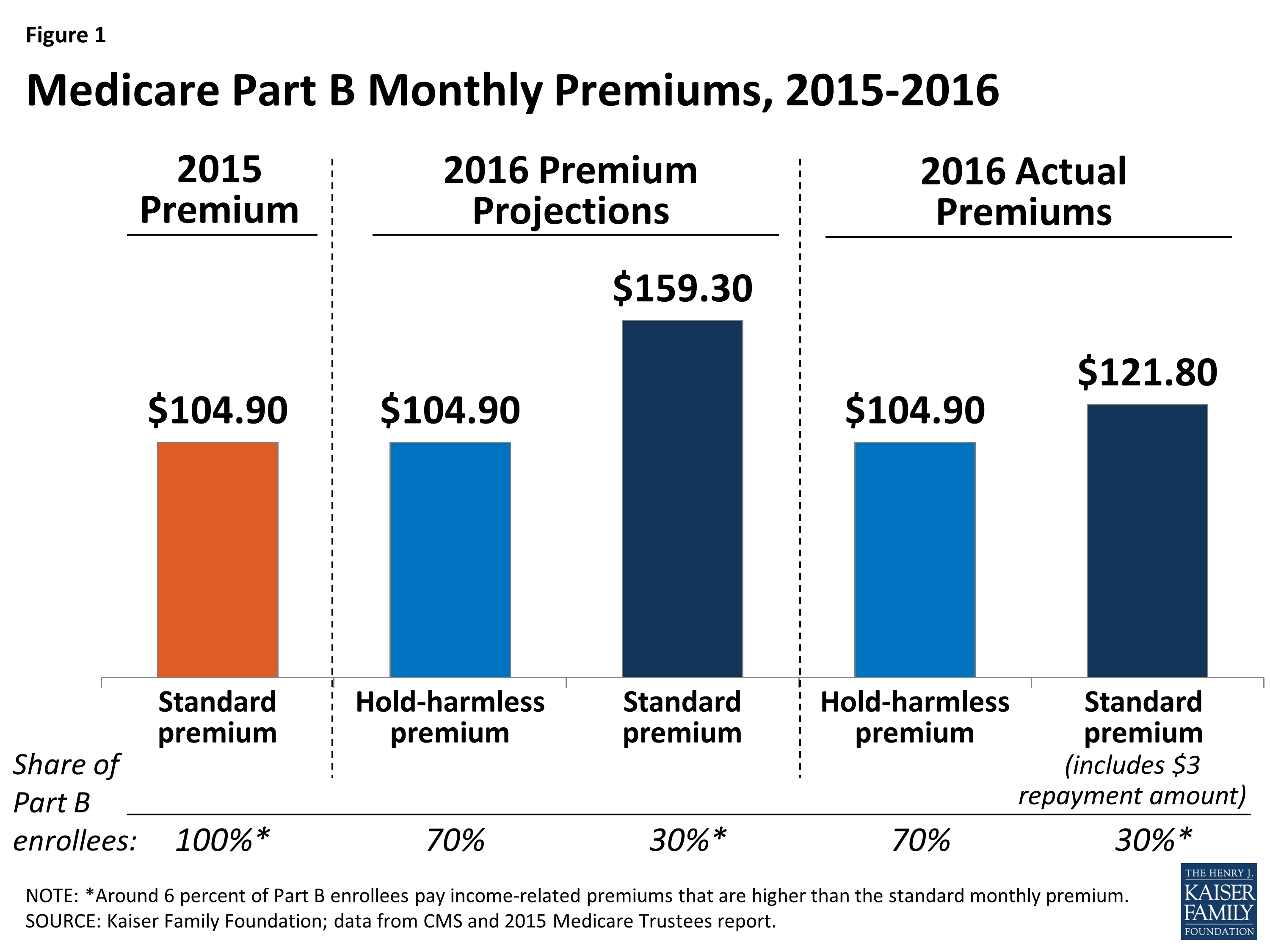

What S In Store For Medicare S Part B Premiums And Deductible In 2016 And Why Kff

What S In Store For Medicare S Part B Premiums And Deductible In 2016 And Why Kff

Can You Deduct Medicare Premiums On Your Tax Return Medicareresources Org

Can You Deduct Medicare Premiums On Your Tax Return Medicareresources Org

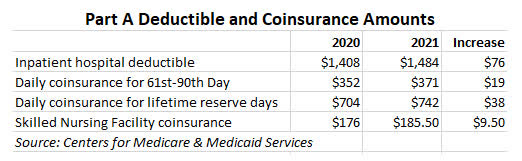

Medicare Costs 2021 Costs Of Medicare Part A And Part B

Medicare Costs 2021 Costs Of Medicare Part A And Part B

I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org

I M Self Employed Can We Deduct My Husband S Medicare Premiums Healthinsurance Org

Is There A Medicare Deductible Medicare Faqs

Is There A Medicare Deductible Medicare Faqs

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Deductibles And Medicare Premiums 2020

Medicare Deductibles And Medicare Premiums 2020

Seniors Can You Deduct Medicare Premiums Gundling Company

Seniors Can You Deduct Medicare Premiums Gundling Company

Medicare Premiums And Taxable Deductions In 2021 Medicarefaq

Medicare Premiums And Taxable Deductions In 2021 Medicarefaq

Seniors Can You Deduct Medicare Premiums Mauldin Jenkins

Seniors Can You Deduct Medicare Premiums Mauldin Jenkins

How Can I Reduce My Medicare Premiums Boomer Benefits

How Can I Reduce My Medicare Premiums Boomer Benefits

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Medicare Cost Medicare Costs 2021 Costs Of Medicare Part A B

Comments

Post a Comment