Us Bond Interest Rates

As of May 2020 Series EE bonds are sold with a 010. 24 rows US T-BOND 2 YEAR.

Understanding Treasury Yield And Interest Rates

The price and interest rate of a bond are determined at auction.

Us bond interest rates. Treasury and basic bond investing tips from CNNMoney including current yield quotes breaking news commentary and more on US. The yield on 30-year Treasury bonds T-bonds dropped to 302. And is the most liquid and widely traded bond in the world.

For example when the Fed increased interest rates in March 2017 by a quarter percentage point the bond market fell. In the United States the Federal Reserves Federal Open Market Committee FOMC sets the federal funds rate. Unlike Series I bonds Series EE bonds are guaranteed to double your initial investment in 20 years.

This is lower than the long term average of 603. Historically the United States 30 Year Bond Yield reached an all time high of 1521 in October of 1981. The current 10 year treasury yield as of April 15 2021 is 156.

10-Year Bond is a debt obligation note by The United States Treasury that has the eventual maturity of 10 years. US 30 Year Bond Yield was 226 percent on Wednesday April 21 according to over-the-counter interbank yield quotes for this government bond maturity. Negative yields for Treasury securities most often reflect highly technical factors in Treasury markets related to the cash and repurchase.

The price may be greater than less than or equal to the bonds par amount or face value. Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of 100. At times financial market conditions in conjunction with extraordinary low levels of interest rates may result in negative yields for some Treasury securities trading in the secondary market.

It also continues earning interest for another 10 years. That supply and demand problem for bonds will lead to a further rise in interest rates which has already wreaked havoc on certain parts of the stock market like the. See rates in recent auctions.

The yield on a Treasury bill. Looking forward we estimate it to trade at 178 in 12 months time. Bonds Center - Learn the basics of bond investing get current quotes news commentary and more.

Your I bond Composite rate for your six-month earning period starting during May 2020 - October 2020 See When does my bond change rates From. Stay on top of current and historical data relating to United States 2-Year Bond Yield. Negative Yields and Nominal Constant Maturity Treasury Series Rates CMTs.

The United States Government Bond 10Y is expected to trade at 163 percent by the end of this quarter according to Trading Economics global macro models and analysts expectations. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity. US 10-Year Government Bond Interest Rate is at 125 compared to 106 last month and 151 last year.

Rates Terms. The 10 year treasury is the benchmark used to decide mortgage rates across the US. Worldwide short-term interest rates are administered by nations central banks.

United States 10-Year Bond Yield Overview. If you spend 500 on a bond it will be worth 1000 or more after two decades.

Interest Rate Spread Chart Of The Week Begin To Invest

Tech Stocks Drag Down Markets As Nasdaq Sheds 3 Financial Times

Tech Stocks Drag Down Markets As Nasdaq Sheds 3 Financial Times

10 Year Treasury Rate 54 Year Historical Chart Macrotrends

10 Year Treasury Rate 54 Year Historical Chart Macrotrends

:max_bytes(150000):strip_icc()/2020-03-13-10YearYield-cf3f5e75a2804d78879841093286b10b.png) 10 Year Treasury Note Definition

10 Year Treasury Note Definition

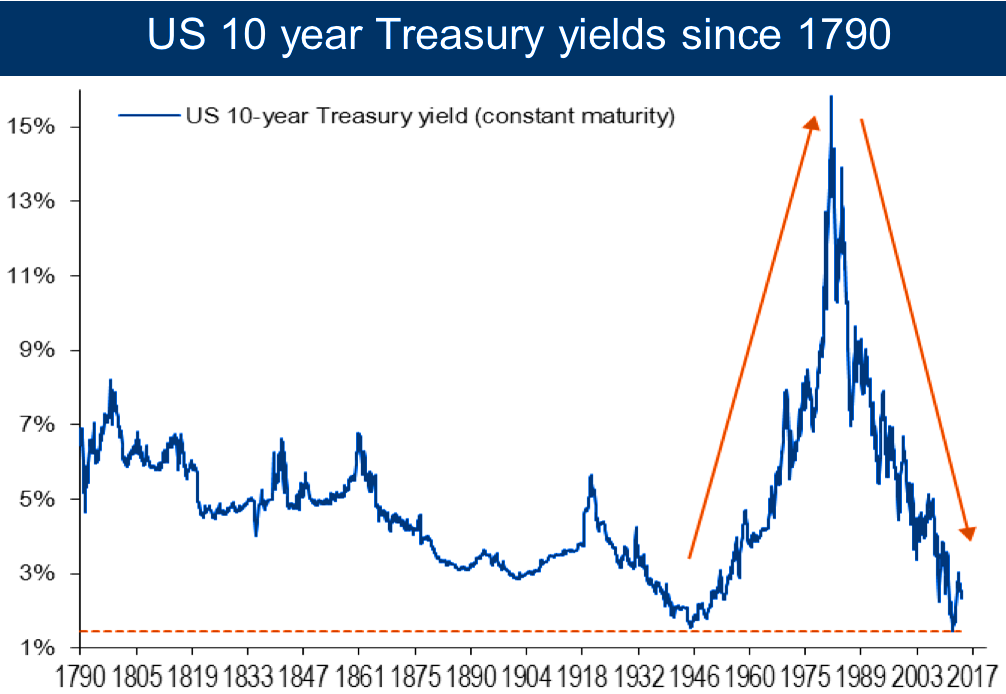

What Interest Rates Can Teach Us About Behavioral Biases

What Interest Rates Can Teach Us About Behavioral Biases

Observations 100 Years Of Treasury Bond Interest Rate History

Observations 100 Years Of Treasury Bond Interest Rate History

30 Year Treasury Bond Rate History Bond Market

Credit Card Interest Rates Soar To Record High Bond Yields Drop To Record Low What Gives Wolf Street

Credit Card Interest Rates Soar To Record High Bond Yields Drop To Record Low What Gives Wolf Street

Education In Times Of Financial Stress What Typically Happens To The Difference Between Interest Rates On Corporate Bonds And U S Treasury Bonds

Education In Times Of Financial Stress What Typically Happens To The Difference Between Interest Rates On Corporate Bonds And U S Treasury Bonds

Will Yields Rise Due To Increased Issuance Of Treasury Bonds Let S Get The Elephant Out Of The Room The Real Economy Blog

Will Yields Rise Due To Increased Issuance Of Treasury Bonds Let S Get The Elephant Out Of The Room The Real Economy Blog

Lowest Interest Rates In 5000 Years Svane Capital

Lowest Interest Rates In 5000 Years Svane Capital

30 Years Of Falling Interest Rates What Is Ahead Of Us Erste Asset Management

U S Bonds Doing The Unexpected Investing Com

U S Bonds Doing The Unexpected Investing Com

.jpg?1418238738)

Comments

Post a Comment