Michigan Gov Income Tax

Please enable JavaScript to continue using this application. This Treasury portal offers one place for taxpayers to manage all their Individual Income Tax needs.

Https Www Michigan Gov Documents Taxes Mi 1040 Instruction Book Instruction Only 545985 7 Pdf

Alternatively you can also only prepare and mail-in a MI state return.

Michigan gov income tax. Credit card payments will be assessed a convenience fee of 235 of the total payment amount. Instructions included on form. To login and take the identity confirmation quiz you will need.

The Treasurers and Income Tax Office is responsible for property tax income tax employer withholding false alarm system registration and invoice payments as. Some cities including Detroit and Saginaw also charge a city income tax which can boost your total tax obligations. 31 2020 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return.

You must file MI-1040 once a year. Quiz ID number from your letter and. With income tax fraud identity theft and data breaches on the rise the Michigan Department of Treasury is increasing security measures.

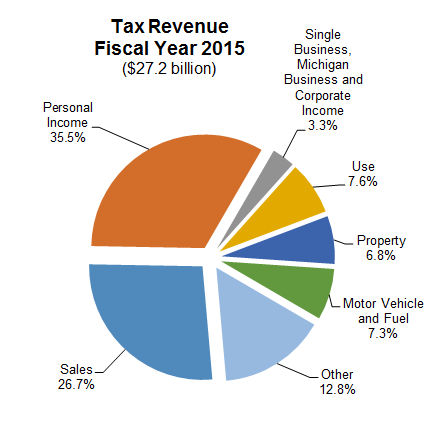

Most taxpayers are required to file a yearly income tax return in April to both the Internal Revenue Service and their states revenue department which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayers entire liability. City Business and Fiduciary Taxes. Miscellaneous Taxes and Fees.

The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2021. 2021 Michigan Income Tax Withholding Tables. Debit card payments will be charged a flat fee of 395.

2021 Michigan Income Tax Withholding Guide. We last updated the Individual Income Tax Return in February 2021 so this is the latest version of Form MI-1040 fully updated for tax. Michigan has a flat income tax system which means that income earners of all levels pay the same rate.

Miscellaneous Taxes and Fees. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal adjusted gross income. Welcome to the NEW eServices portal.

If you earned income in Michigan you may have to file income taxes with the Michigan Department of Treasury using Form MI-1040 Individual Income Tax Return. 4927-SSA born after 1952. 425 of taxable income.

If you filed a Michigan Individual Income Tax Return MI-1040 use the refund amount from the return year referenced in your letter. Michigan Pension and Retirement Payments Withholding Tables. The latest deadline for e-filing a Michigan Tax.

This system contains US. Get the latest updates and resources from the State of MichiganLearn more. Sales and Use Tax.

City Individual Income Tax. Sales and Use Tax. That is one of the lowest rates for states with a flat tax.

As of 2018 Michigan tax payers pay a flat income tax rate of 425 percent. We have everything individuals businesses and withholders need to file taxes with the City. Miscellaneous Taxes and Fees.

Michigan Income Taxes. You may file online with efile or by mail. Please enable JavaScript to continue using this application.

Detailed Michigan state income tax rates and brackets are available on this page. City Individual Income Tax. All Michigan Individual Income Tax filers may choose to make a payment using a debit or credit card.

Withholding Tables for Pension and Retirement Payments from a Governmental Entity and Exempt from Social Security. By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state and federal criminal prosecution and penalties as well as civil penalties. The Michigan State Income Taxes for Tax Year 2020 January 1 - Dec.

Form MI-1040 is the most common individual income tax return filed for Michigan State residents. The identity confirmation quiz is one of the ways the Department is protecting your information. Income Tax The Income Tax departments library of Income Tax Forms.

24 rows Individual Income Tax Payment Voucher. If you filed a Michigan Homestead Property Tax Credit Claim MI-1040CR and no MI-1040 return was filed use the amount on line 44. City Individual Income Tax.

Sales and Use Tax.

807 261955 7 Michigan Gov Documents Taxes

807 261955 7 Michigan Gov Documents Taxes

Https Www Michigan Gov Documents Taxes Mi 1040 Book Instructions 477624 7 Pdf

Michiganders Can Check Their Filing Status Online News The Daily Reporter Coldwater Mi Coldwater Mi

Michiganders Can Check Their Filing Status Online News The Daily Reporter Coldwater Mi Coldwater Mi

Make Michigan Individual Income Tax E Payments

Make Michigan Individual Income Tax E Payments

2771f 2901 7 Michigan Gov Documents Taxes

2771f 2901 7 Michigan Gov Documents Taxes

Gov T Affairs News Personal Income Tax Tobacco 21 And More Michigan Retailers Association

Gov T Affairs News Personal Income Tax Tobacco 21 And More Michigan Retailers Association

Https Www Michigan Gov Documents Web Resources 139496 7 Pdf

2019 Michigan City Income Taxes 1 Mi City

2019 Michigan City Income Taxes 1 Mi City

Make Michigan Individual Income Tax E Payments

Make Michigan Individual Income Tax E Payments

Mi 1040cr 2booklet Michigan Gov Documents Taxes

Mi 1040cr 2booklet Michigan Gov Documents Taxes

Https Www Michigan Gov Documents Taxes Mi 1040 Book No Forms 642357 7 Pdf

Comments

Post a Comment