State Gas Tax Rates

1 Tax rates do not include local option taxes. The tax would be raised by 10 cents this year and by another 8 cents in 2022.

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

Pennsylvania lowered taxes by six tenths of a cent but the state still has the highest gas taxes.

State gas tax rates. On average as of April 2012 state and local taxes add 311 cents to gasoline and 302 cents to diesel for a total US average fuel tax of 495 cents cpg per gallon for gas and 546 cents per gallon cpg for diesel. 6 State gas taxes help fund things like road repair road construction and necessary maintenance. The 16-year 26 billion funding package includes an 18-cent increase in the gas tax rate.

52 rows Which State has the Highest Tax Rate. Do I Need to Pay So Much for Gas. HI 88 to 180 cent.

NV 40 to 90 cents. Household Difference Between State US. In AL 1 - 3 cents.

The state with the highest tax rate on. What are the motor fuel tax rates. SD and TN one cent.

Statewide Fuel Taxes on Undyed Diesel Fuel Excise Sales 9th-Cent Local Option SCETS Total All Counties 0040 0145 001 006 008 0335 Statewide Fuel Taxes on Aviation Fuel State Tax Effective Date of Tax Rate All Counties 00427 July 1 2019 Forward New Taxes. Applicable in addition to all state taxes. Federal Income Tax - Minimum Bracket 10 Maximum Bracket 396.

1115 per gallon. State and Local Issues. 19957 KB Download state_gas_ratesxlsx.

2568 per gallon. 51 rows This means that the gas tax is relatively well distributed throughout the USit skewed only. The tax rates are.

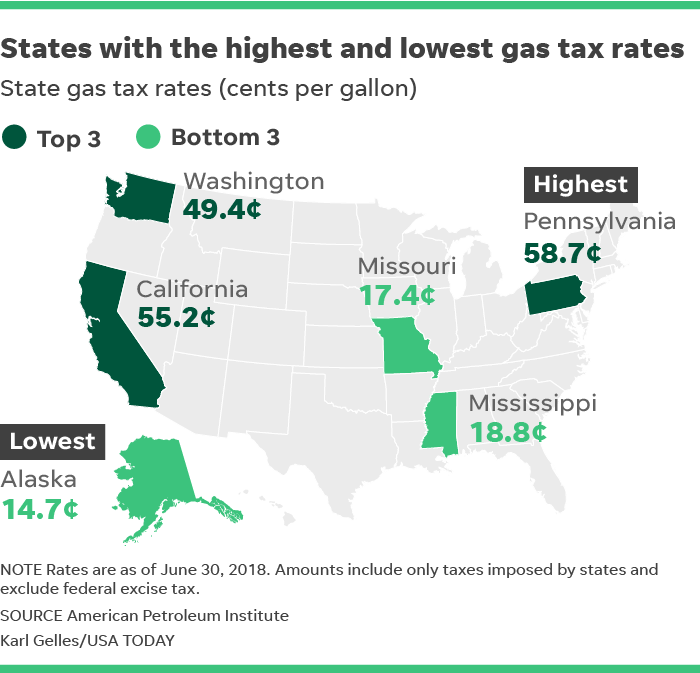

Effective Total State Local Tax Rates on Median US. California pumps out the highest tax rate of 612 cents per gallon followed by Pennsylvania 587 cpg Illinois 5498 cpg and Washington 494 cpg. 1161 per gallon.

Washington House Democrats have announced plans to pursue an increase of the states 494-cent fuel tax rate. The United States federal excise tax on gasoline is 184 cents per gallon cpg and 244 cents per gallon cpg for diesel fuel. 2624 per gallon.

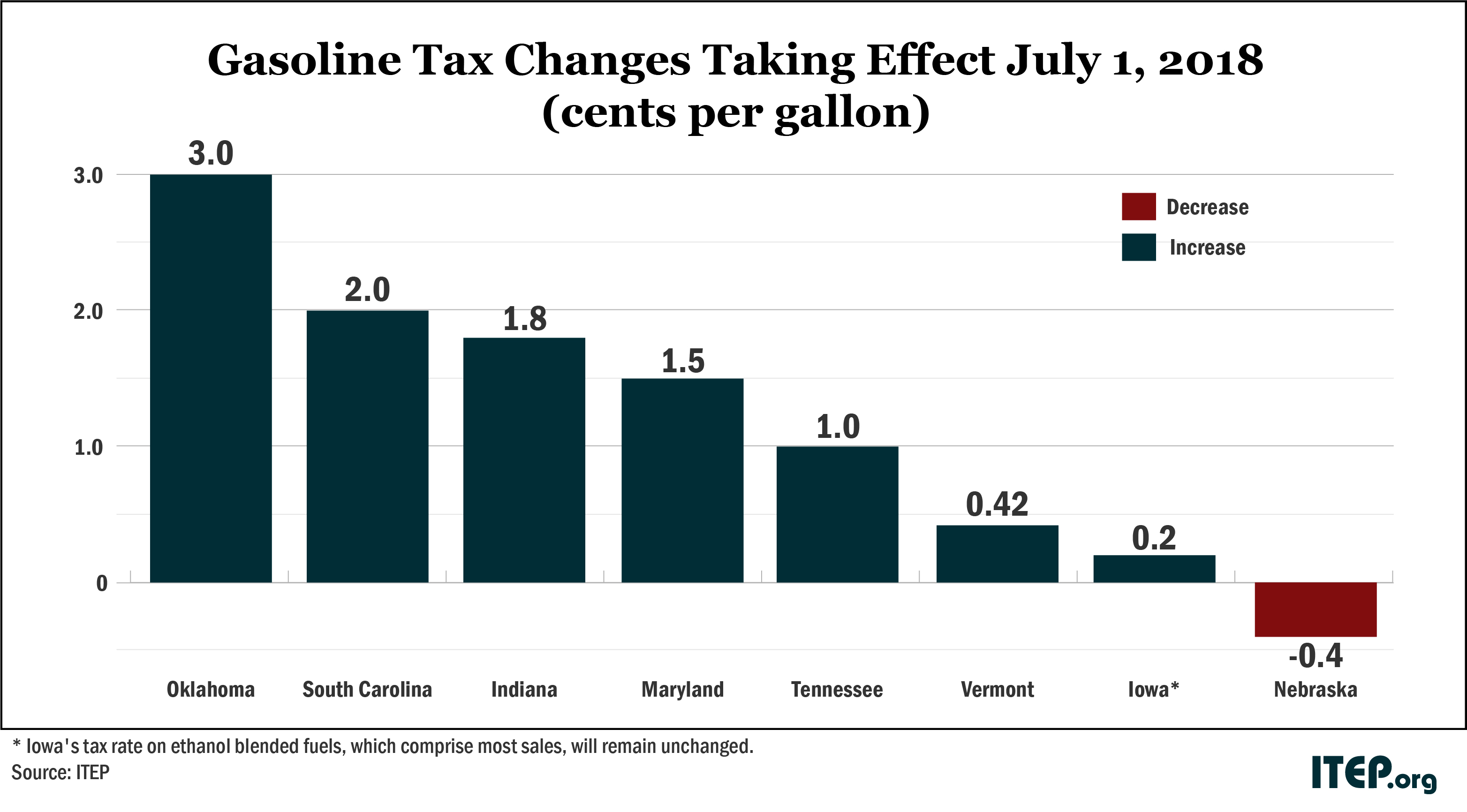

At the start of this 2018 seven states raised taxes on gasoline while two states lowered the tax. Persons who first transfer sell or use if the motor fuel tax was not previously paid motor fuel in the state are subject to the tax. IL 5 cents in Chicago and 6 cents in Cook county gasoline only.

The average state gasoline tax as of July 2020 was 2986 cents per gallon. Youll find the lowest gas tax in Alaska at 1466 cents per gallon followed by Missouri 1742 cpg and Mississippi 184 cpg. State Motor Fuels Tax Rates.

Included in the Gasoline DieselKerosene and Compressed Natural Gas rates is a 01 per gallon charge for the Leaking Underground Storage Tank Trust Fund LUST. 08 cents per gallon for diesel and gasoline highway use. The county tax rate ninth-cent SCETS and local option tax rates on diesel fuel will increase from 149 cents per gallon to 150 cents per gallon statewide.

How High Are Gas Taxes in Your State. Diesel Fuel The state tax rate on diesel fuel will increase from 183 cents per gallon to 185 cents per gallon. 14867 KB April 8 2021.

In addition to state taxes of at least 4 per gallon of gas the federal government levies a tax of 184 cents on every gallon of gas sold in the US. Avg Annual State Local Taxes on Median State Household Adjusted Overall Rank based on Cost of Living Index 1. Federal excise tax rates on various motor fuel products are as follows.

OR 1 to 5 cents. Household Annual State Local Taxes on Median US. Compare 2020 state fuel excise taxes by state 2020 gas tax rates by state and 2020 state gas tax rates with new map.

Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. The map below breaks downs gas tax by state. California pumps out the highest tax rate of 6247 cents per gallon followed by Pennsylvania 587 cpg Illinois 5201 cpg and Washington 494 cpg.

.png) Map State Gasoline Tax Rates Tax Foundation

Map State Gasoline Tax Rates Tax Foundation

Rising Gas Taxes Which States Have Highest And Lowest Rates

Rising Gas Taxes Which States Have Highest And Lowest Rates

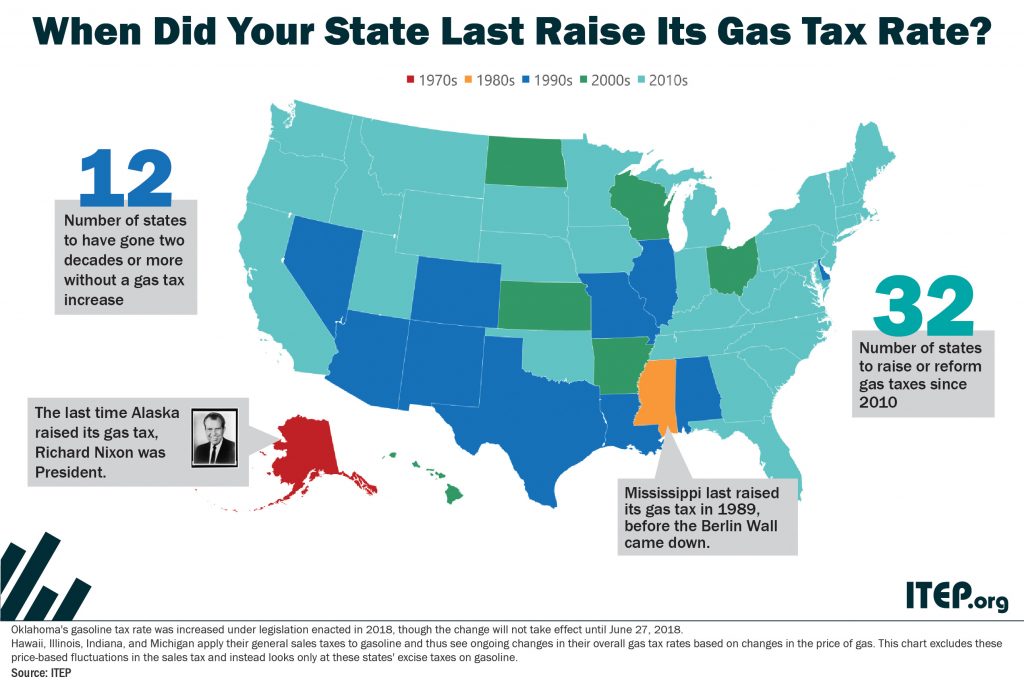

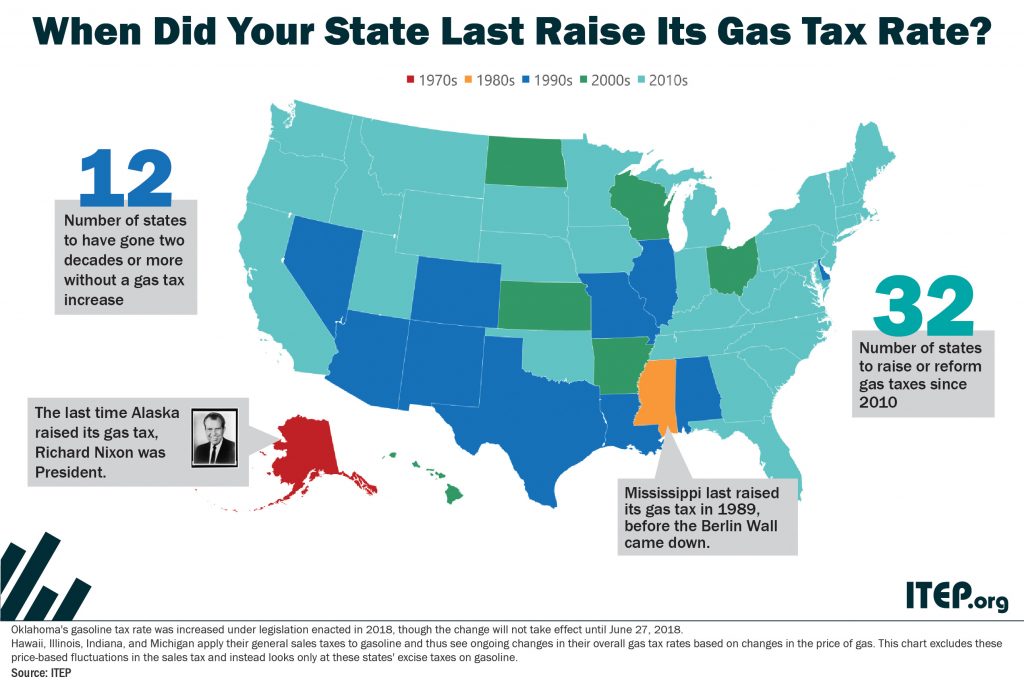

How Long Has It Been Since Your State Raised Its Gas Tax Itep

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Map Of Gasoline Tax Rates By State The Bull Elephant

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

Gas Tax Rates July 2018 State Gas Tax Rankings Tax Foundation

When Did Your State Adopt Its Gas Tax Tax Foundation

When Did Your State Adopt Its Gas Tax Tax Foundation

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

Map State Gasoline Tax Rates As Of January 2010 Tax Foundation

Map State Gasoline Tax Rates As Of January 2010 Tax Foundation

Fuel Taxes In The United States Wikipedia

Fuel Taxes In The United States Wikipedia

What Is The Gas Tax Rate Per Gallon In Your State Itep

What Is The Gas Tax Rate Per Gallon In Your State Itep

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Map Of State Gasoline Tax Rates In 2014 Tax Foundation

Comments

Post a Comment