Benefits Of Reverse Mortgage

A reverse mortgage is what we call a non-recourse loan. Possibly the greatest benefit of all reverse mortgage programs may help seniors remain in their homes that they have worked so hard to pay for throughout their lives.

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

Borrowers do not have to repay the loan until they move from the property sell it or in case of death.

Benefits of reverse mortgage. Following are the advantages of reverse mortgages. Payments can be made as follows. Monthly for as long as the borrower occupies the home.

Homeowners have less stress and feel freer to live the life they want. With COVID -19 stirring the pot it is good to have the worry of the future and retirement at. However a reverse mortgage is a costly and complicated financial contract that should be entered into with care.

Benefits of Reverse Mortgage. Homeowners have the ability to tap into the equity of their home while still retaining ownership of the property. Reverse mortgages allow a homeowner to borrow equity.

Who benefits from a reverse mortgage are senior borrowers with high equity in their homes and a need for more income each month. A reverse mortgage allows property owners 62 and older to convert real estate equity into spendable cash. One of the most significant benefits of reverse mortgage is that the money you receive is exempt from taxes.

Purchasing a Home Using a Home Equity Conversion Mortgage. While you will have to continue paying property taxes insurance and other mandatory expenses as a homeowner the proceeds from your RM loan are non-taxable. Banks also benefit because they make good profits on these loans.

If youre in need of additional funds this is a major way you can benefit. This is quite different from a traditional forward mortgage where you must pay funds in a monthly amount. There is Limited Downside and More Benefits of Reverse Mortgage for Seniors.

Throughout the term of the loan the lender makes payments directly to you. With a reverse mortgage homeowners receive upfront funds through single payments or monthly installments. Instead of making payments to the lender the lender makes payments to the borrower.

The main advantage of Reverse Mortgages is that you can eliminate your traditional mortgage payments andor access your home equity while still owning and living in your home. Homeowners who wish to stay in their homes and maintain the lifestyle they are accustomed. Payments are structure assuming you will stay in your home until you are 100 years old.

It does not create immediate financial liability on the borrower as heshe does not need to repay the loan amount in EMIs. The loan is repaid by the sale or refinancing of the home. So why is a Reverse Mortgage beneficial.

Here are a few benefits to opting for a reverse mortgage. The vast majority of reverse mortgages are insured through the Federal Housing. The liability is only to the extent of the value of your home at time of sale death or vacating the premises.

This means that with a reverse mortgage you are not personally liable. Often used when downsizing or relocating this strategy preserves liquid funds that would otherwise become illiquid when used to buy the new house. Its a unique financial system where the benefits outweigh the cons.

Who benefits most from a reverse mortgage. Combination of any of the above. Given the right set of circumstances a Reverse Mortgage can be an ideal way to increase your spending power and financial security in retirement.

One of the most attractive benefits of reverse mortgages is that payments are made TO you as long as you live in your home. Periodic advances through a line of credit. With reverse mortgages you receive funds.

Benefits of a Reverse Mortgage The main advantage of a Reverse Mortgage or Home Equity Conversion Mortgage HECM is that you can eliminate your traditional mortgage payments andor access your home equity while still owning and living in your home. One of the benefits of a reverse mortgage is the ability to purchase a home. Helps Secure Your Retirement Reverse mortgages are ideal for retirees who dont have a lot of cash savings or investments but do have a.

Several noteworthy benefits offered by this type of loan structure include. Reverse mortgage ensures financial well-being in old age and provides monetary independence to senior citizens. Looking at the reverse mortgage basics HECM loans are often seen as attractive financing method.

Enhance Your Finances Another one of the many benefits of reverse mortgage is the ability to enhance or increase your incomefinances. A reverse mortgage can provide a way for seniors to stay in their house and pull from the equity they have built up in their homes without selling it outright.

15 Ways Reverse Mortgage Benefits Can Help Retirees

15 Ways Reverse Mortgage Benefits Can Help Retirees

Reverse Mortgage Vs Heloc Alpha Mortgage Reverse Division

Reverse Mortgage Vs Heloc Alpha Mortgage Reverse Division

Benefits Of A Reverse Mortgage Effective Mortgage Company

Benefits Of A Reverse Mortgage Aag Reverse Mortgage Advantages

Benefits Of A Reverse Mortgage Aag Reverse Mortgage Advantages

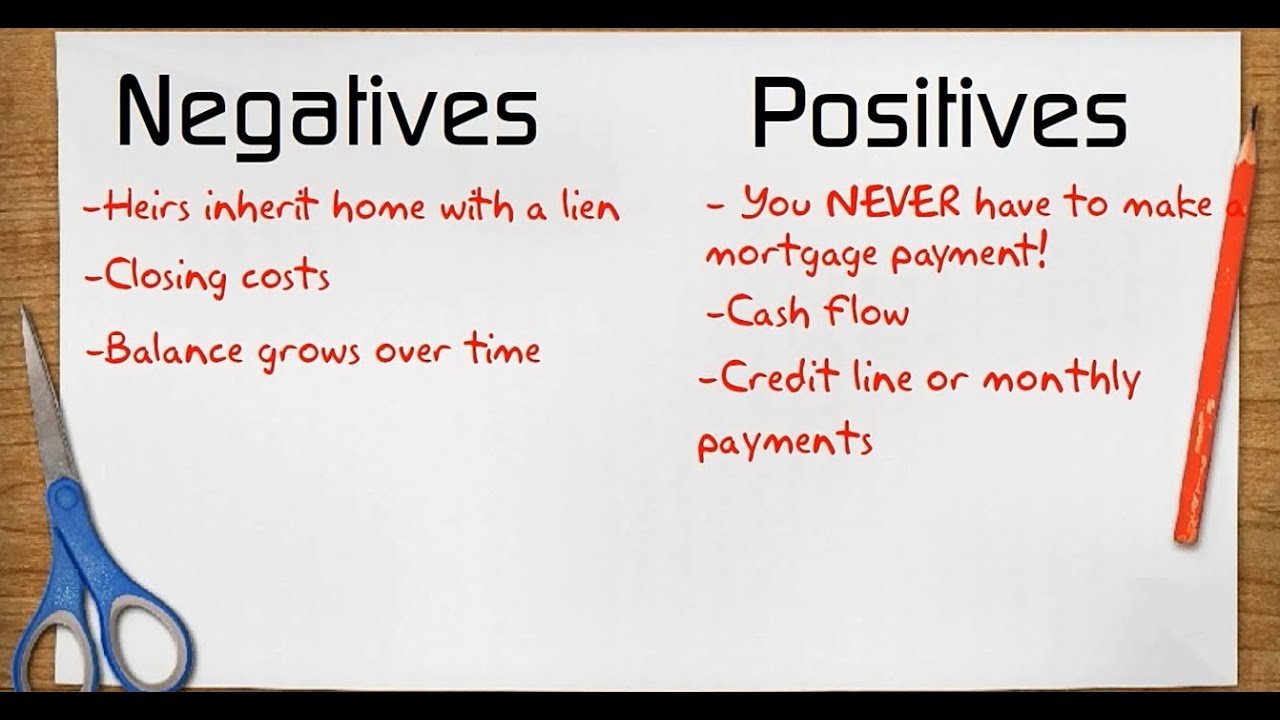

What Is A Reverse Mortgage How Do They Work Millionacres

What Is A Reverse Mortgage How Do They Work Millionacres

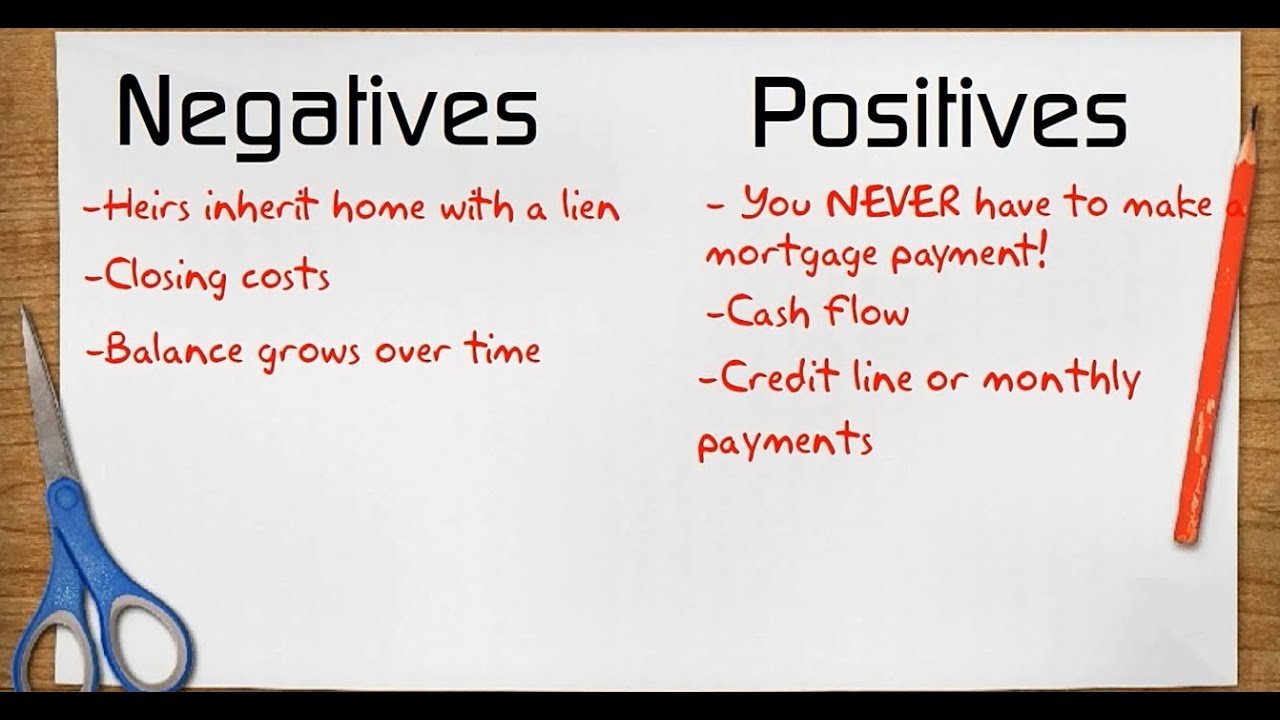

Reverse Mortgage Pros And Cons Is A Reverse Mortgage Right For You Youtube

Reverse Mortgage Pros And Cons Is A Reverse Mortgage Right For You Youtube

Ask An Attorney Should I Consider A Reverse Mortgage Las Vegas Sun Newspaper

Ask An Attorney Should I Consider A Reverse Mortgage Las Vegas Sun Newspaper

What Is A Reverse Mortgage Explaining What A Hecm Is

What Is A Reverse Mortgage Explaining What A Hecm Is

The 5 Benefits Of Chip Reverse Mortgages Jenni Macdonald Dominion Lending Centres

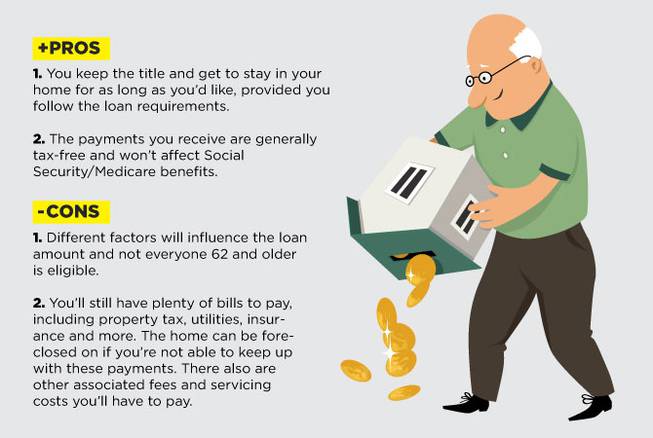

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

Reverse Mortgage Solutions Learn The Benefits Of Reverse Mortgages In California Umax Mortgage

/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg) 5 Signs A Reverse Mortgage Is A Bad Idea

5 Signs A Reverse Mortgage Is A Bad Idea

Benefits Of Getting A Reverse Mortgage Z Reverse Mortgage

Benefits Of Getting A Reverse Mortgage Z Reverse Mortgage

Comments

Post a Comment