How Often Can I Apply For A Credit Card

If youve received a credit limit increase or a credit limit decrease in the last six months you wont be approved for a credit limit increase. Our Experts Found the Best Credit Card Offers for You.

/denied-credit-card-application-960247-v1-0aa7e53830ea4a508ab8366f8d5bde26.png) Possible Reasons A Credit Card Application Was Denied

Possible Reasons A Credit Card Application Was Denied

You can only apply for 1 personal card every 8 days and no more than 2 in a 65-day window.

How often can i apply for a credit card. When You Might Want to Wait to Apply for a New Credit Card. Youve recently applied for a credit card. When you shouldnt apply for a credit card.

But how long you should wait to apply depends on your credit score. You technically can submit credit card applications as often as you like but opening credit card accounts too often could backfire. You can only apply for 1 business card every 95 days.

In any case if youre approved and eligible for a welcome bonus make sure you are able to complete minimum spending requirements within the time period allotted. Is it bad to apply for credit cards multiple times. I mainly choose cards based on my travel plans.

This one-time offer is valid for eligible cardmembers. I dont know how they do it and sometimes why they do it - I cannot imagaine why anyone needs 40 credit cards - or even 20 - I have 8 and I may add 2 or 3 more - but that is enough for me. Providing you have a Very Good or Excellent credit score you should be able to get approved for a new credit card every 3-4 months in Australia.

Our Experts Found the Best Credit Card Offers for You. Ideally youd want to space applications for new credit cards. Thankfully Citi is offering an extra three months to meet minimum spend requirements due to COVID-19 for new card applications through May 31 2020.

When you apply for credit a lender generally will request a copy of your credit reportthis is called a hard inquiry. Never apply for a new credit card when youll also be applying for a large loan like a mortgage or a car loan within the next six months. You may be able to get approved for more than two cards in a 90-day period.

Nothing is stopping you from applying for two or more credit cards in a short period of time or even at the same time. You can typically only be approved for one Barclays card every six months. However most of these reports were a combination of credit and charge cards so the general rule of thumb is that you shouldnt apply for three or more Amex credit cards within three months.

That time allows you to meet minimum spend for the bonus points see them credited to your frequent flyer account and your credit score to recover. If youve recently applied for a credit card it may be a good idea to wait six months before trying to open another account. How Often Can I Apply For A New Credit Card.

Waiting about six months between credit card applications is a good rule of thumb and can increase your chances of approval. How Often to Apply for a New Credit Card OP - You will go crazy if you try and compare yourself to some of the credit gods here. If you have many recent credit inquiries your credit score can suffer as the formula interprets this behavior as a potential indicator of future credit problems.

Capital One lets you request a credit limit increase online as often as you want but you can only be approved once every six months. In addition each card has specific language like these terms from the AAdvantage Aviator Red World Elite Mastercard. The typical recommendation is that you should wait six months between credit card applications.

On the downside each time you apply for a new credit card an inquiry sometimes called a hard pull will be recorded on your credit history. Too many hard inquiries in a brief time is a red flag for lenders who may interpret them as a sign that youre not a responsible manager of credit. My rationale is to only apply for credit cards based on my ability to hit the minimum spend requirement to get the signup bonus.

In the past I talked about how I meet minimum spend through paying rent. If youre planning to time your applications around these restrictions you may want to wait a few extra days past the 65-day and 95-day windows just to play it safe. Applying for a new credit card can produce a small temporary drop in your credit score.

While the number of credit cards you should have is up to you and you can apply for new lines of credit as often as you want its a good idea to wait at least 90 days between new credit card. There are circumstances in which you should wait to apply for a new credit card. For me this means that I apply for a new card every 3-4 months.

If you have good credit you can probably get away with submitting another credit card application within three months or less. Ad Get a Card with 0 APR Until 2022. Ad Get a Card with 0 APR Until 2022.

How Often Can I Apply For A Credit Card Affordable Credit Card

How Often Can I Apply For A Credit Card Affordable Credit Card

How Often Can I Apply For A Credit Card Affordable Credit Card

How Often Can I Apply For A Credit Card Affordable Credit Card

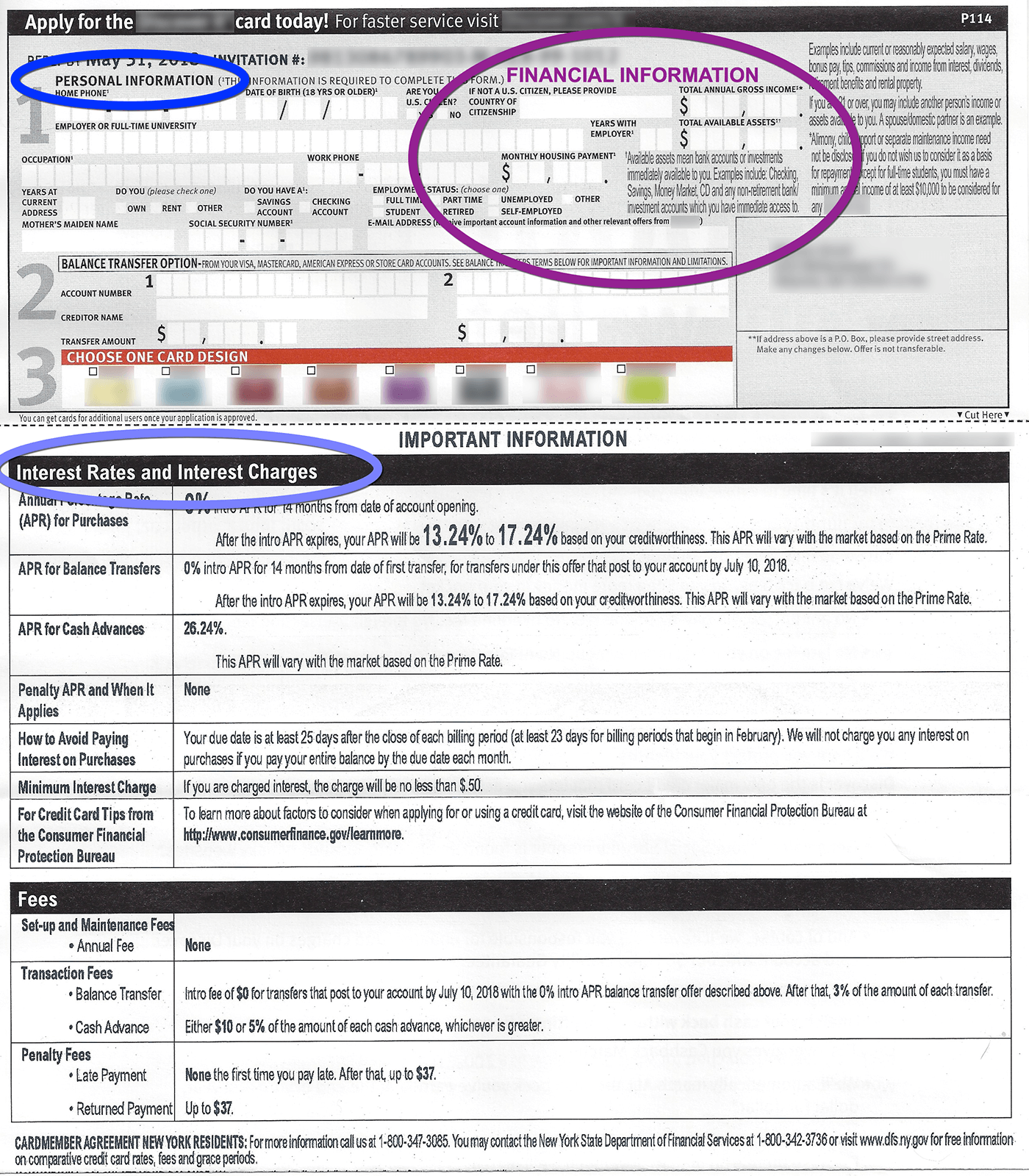

How Often Should I Apply For A Credit Card Best Way To Apply For A Credit Card Credit Card Pictures Best Credit Cards Credit Card Fees

How Often Should I Apply For A Credit Card Best Way To Apply For A Credit Card Credit Card Pictures Best Credit Cards Credit Card Fees

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

How Often Should You Apply For A New Credit Card Youtube

How Often Should You Apply For A New Credit Card Youtube

Applying For Multiple Chase Cards At Once Reviewing Chase S 2 30 Rule Youtube

Applying For Multiple Chase Cards At Once Reviewing Chase S 2 30 Rule Youtube

How To Apply For A Credit Card Experian

How To Apply For A Credit Card Experian

How Often Can You Open New Credit Card Accounts Us News

How Often Can You Open New Credit Card Accounts Us News

How Often Can I Apply For A Credit Card Affordable Credit Card

How Often Can I Apply For A Credit Card Affordable Credit Card

How Often Can I Apply For New Credit Cards Without Hurting My Credit Scores Credit Com

How Often Can I Apply For New Credit Cards Without Hurting My Credit Scores Credit Com

Free Download How Often Should You Apply For A New Credit Card Mp3 With 13 26

Free Download How Often Should You Apply For A New Credit Card Mp3 With 13 26

How To Apply For A Credit Card Approval Requirements

How To Apply For A Credit Card Approval Requirements

The Noob Af Guide How To Apply For Credit Cards In Singapore

The Noob Af Guide How To Apply For Credit Cards In Singapore

Comments

Post a Comment