Nys Income Tax 2020

Use the NYS tax computation. Be sure to use the correct mailing address for your personal income tax return and avoid common filing errors.

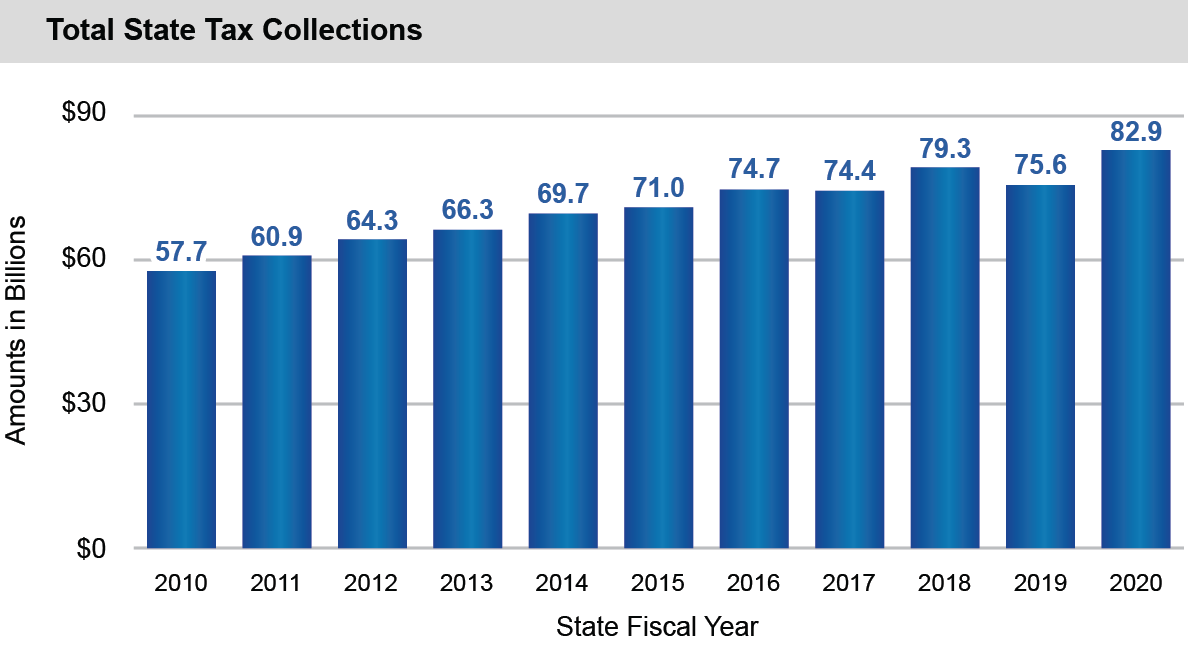

Taxes Office Of The New York State Comptroller

Taxes Office Of The New York State Comptroller

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Nys income tax 2020. To be sure you arent charged a fee access the Free File software thats right for you directly. Nonresident group and team returns. New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount.

Rates kick in at different income levels depending on your filing status. The New York tax rate is mostly unchanged from last year. 2020 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. AND NYS taxable income is 65000 or MORE. New York will continue to apply state income tax to 2020 unemployment benefits in full despite the federal government exempting the first 10200.

Partnership and LLCLLP forms. Its our no-cost way to easily complete and file your federal and New York State income tax returns online. For more information see Free File your income tax return.

AND NYS taxable income is LESS than 65000. NYS tax rate schedule. New York State Tax.

New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. At the Governors direction the Department of Tax and Finance will be extending the New York State income tax deadline to May 17 to align with the federal decision to do the same. 9 rows New York State Standard Deduction 2020 New York is one of the wealthiest.

Weve partnered with the Free File Alliance again to offer you more options to e-file your New York State income tax returnat no cost. New York Income Tax Rate 2020 - 2021. New York City has four tax brackets ranging from 3078 to 3876.

The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. Get Results from multiple Engines. Ad Search For Relevant Info Results.

Prepare and file your income tax return with Free File. NYS adjusted gross income is MORE than 107650. If your 2020 income was 72000 or less youre eligible to use Free File income tax software.

Ad Search For Relevant Info Results. New York Income Tax Forms View Past Years Brackets New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. New York Income Taxes.

Find the forms you need - Choose Current year forms or Past year forms and select By form number or By tax type. New York City or Yonkers Tax. The state applies taxes progressively as does the federal government with higher earners paying higher rates.

The New York City income tax is one of the few negatives of living in this incredible city. You can prepare and e-file both your federal and state returns using Free File. If your 2020 income is 72000 or lessyes.

NYS adjusted gross income is 107650 or LESS. Am I eligible to Free File. Most commonly viewed tax types - Find current year forms by selecting from the list below.

Estimated tax forms. Metropolitan commuter transportation mobility tax MCTMT Sales tax. For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in.

Get Results from multiple Engines. Today well explore what it is the rates for 2020 as well as deductions and available credits. Taxpayers with an adjusted gross income of less than 150000 will not pay federal income taxes on the first 10200 received for unemployment benefits in.

Part-year NYC resident tax.

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

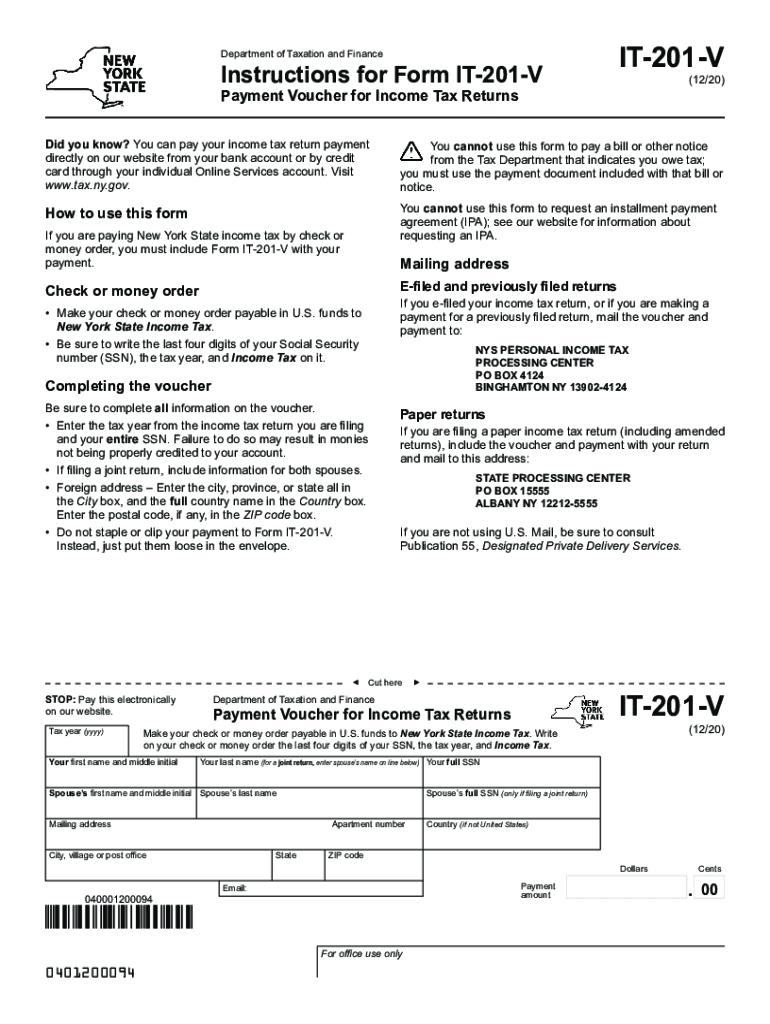

New York Tax Forms 2020 Printable State Ny Form It 201 And Ny Form It 201 Instructions

New York Tax Forms 2020 Printable State Ny Form It 201 And Ny Form It 201 Instructions

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

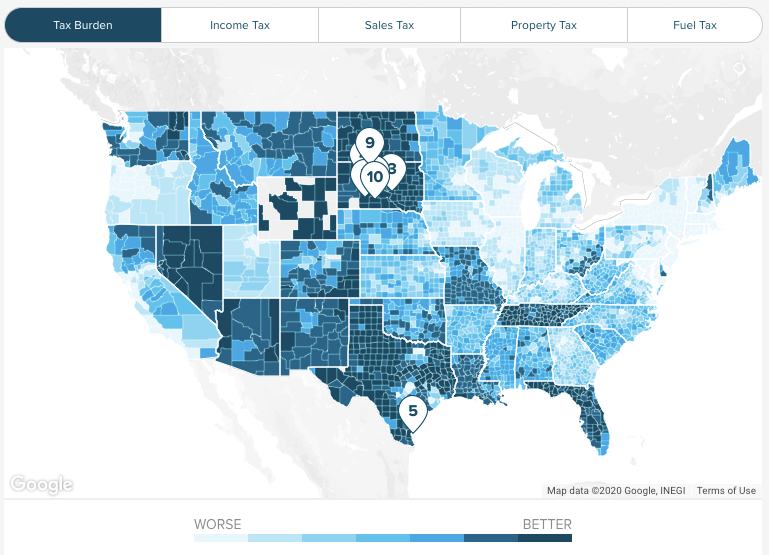

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

New Yorkers Paid Less In Federal Taxes In First Year Of New Federal Tax Law Empire Center For Public Policy

Taxes Office Of The New York State Comptroller

Taxes Office Of The New York State Comptroller

What You Need To Know About 2020 Taxes Advisors Management Group

What You Need To Know About 2020 Taxes Advisors Management Group

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

Your First Look At 2020 Tax Rates Projected Brackets Standard Deduction Amounts And More

Https Www Tax Ny Gov Pdf Current Forms It It201i Pdf

Ny It 201 V 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ny It 201 V 2020 2021 Fill Out Tax Template Online Us Legal Forms

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

Covid 19 S Toll On The Local Economy A Preliminary Estimate Of Job Losses Tax Revenue Declines

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Comments

Post a Comment