New York State Sales Tax Rate 2020

An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. New York City has the states highest tax rates at 8875.

Https Www Nysac Org Files Nysactaxwhitepaper 1 Pdf

If you need access to a database of all New York local sales tax rates visit the sales tax data page.

New york state sales tax rate 2020. All eligible counties and 18 cities including New York City impose a sales tax at rates ranging from 3 percent to 475 percent. STATE SALES TAX RATE. State Revenue Department websites Lower Higher VT NH 622 36 A 625 35 CT 635 33 RI 700 24 NJ 660 30 DE MD 600 38 C 600 38 Combined State Average Local Sales Tax Rates A2 5 T ID 603 37 ND 686 29 MN.

LOCAL SALES TAX RATE. New York State Sales and Use Tax Rates by Jurisdiction - Publication 718 - Effective August 1 2019 Updated. Easy Fast And Secure Booking With Instant Confirmation.

New York City has its. The County sales tax rate is 4. New York has a 4 sales tax and Orange County collects an additional 375 so the minimum sales tax rate in Orange County is 775 not including any city or special district taxes.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The New York sales tax rate is 0. Common goods that are exempt from sales tax include groceries and clothing or footwear that cost less than 110.

The New York sales tax rate is currently 4. The County sales tax rate is 4. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax.

The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district. This is the total of state county and city sales tax rates. The state general sales tax rate of New York is 4.

The latest sales tax rate for Brooklyn NY. This table shows the total sales tax rates for all cities and towns in Orange County including all local taxes. Most counties share a portion of their sales tax revenue with cities towns villages andor school districts within their borders10.

48 rows STATE NAME. The New York sales tax rate is currently 4. The December 2020 total local sales tax rate was also 8875.

January 30 2020 Department of Taxation and Finance. This is the total of state county and city sales tax rates. 1652 rows Average Sales Tax With Local.

Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. The result is that you can expect to pay between 7 and 8875 sales tax in New York. Click any locality for a full breakdown of local property taxes or visit our New York sales tax calculator to lookup local rates by zip code.

2020 rates included for use while preparing your income tax deduction. The Rochester sales tax rate is 0. Cities andor municipalities of New York are allowed to collect their own rate that can get up to 475 in city sales tax.

Easy Fast And Secure Booking With Instant Confirmation. 2020 The State rate remains at 4 percent. Combined State Average Local Sales Tax Rates January 1 2020 TAX FOUNDATION Sources.

New York has state sales tax of 4 and allows. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848. This rate includes any state county city and local sales taxes.

Sales tax rates. The current total local sales tax rate in New York City NY is 8875.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

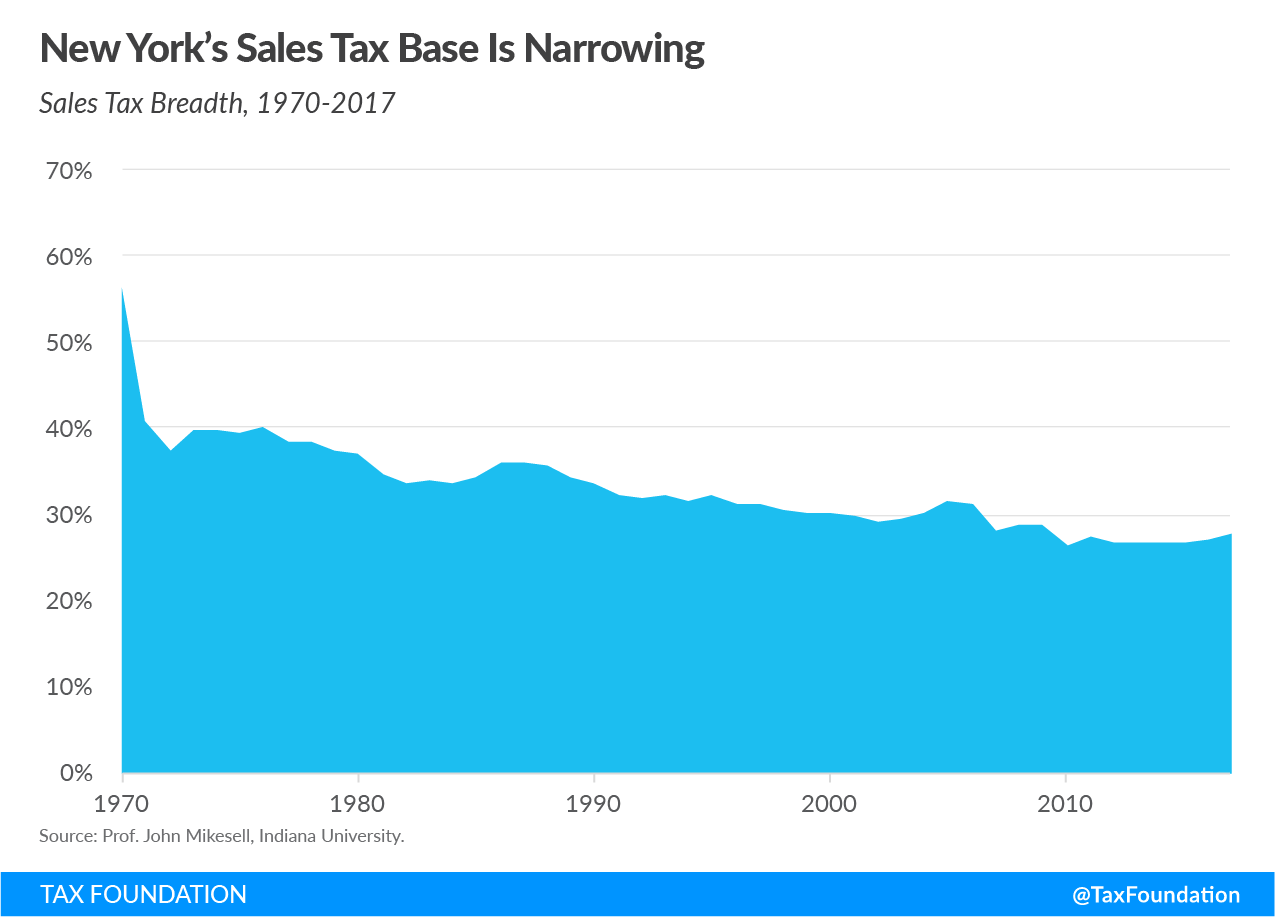

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

New York Sales Tax Rate Rates Calculator Avalara

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

/new-york-city-taxes-141a08d29b504e2fb8bf658eb5777c35.png) An Overview Of Taxes In New York City

An Overview Of Taxes In New York City

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Sales Tax Rates Sales Tax Institute

State Sales Tax Rates Sales Tax Institute

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

Comments

Post a Comment