Taxes On Investment Accounts

Local and foreign interest. 0 15 or 20 depending on your tax bracket.

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

Tax free savings account Section 12J investment FAQs Investors have to pay tax when they earn money on their investments like shares or unit trusts.

Taxes on investment accounts. If you are a basic rate taxpayer you will pay 10 CGT on you profits over 12300. You can convert a traditional IRA. These types of investments have a capital gains tax rate that could be as high as 28.

If you are a higher or additional rate taxpayer you will pay 28 CGT on your gains from residential property and 20 on your gains from other chargeable assets. Traditional type investment accounts for retirement are generally funded with pre-tax dollars. The capital gains rate you pay depends on.

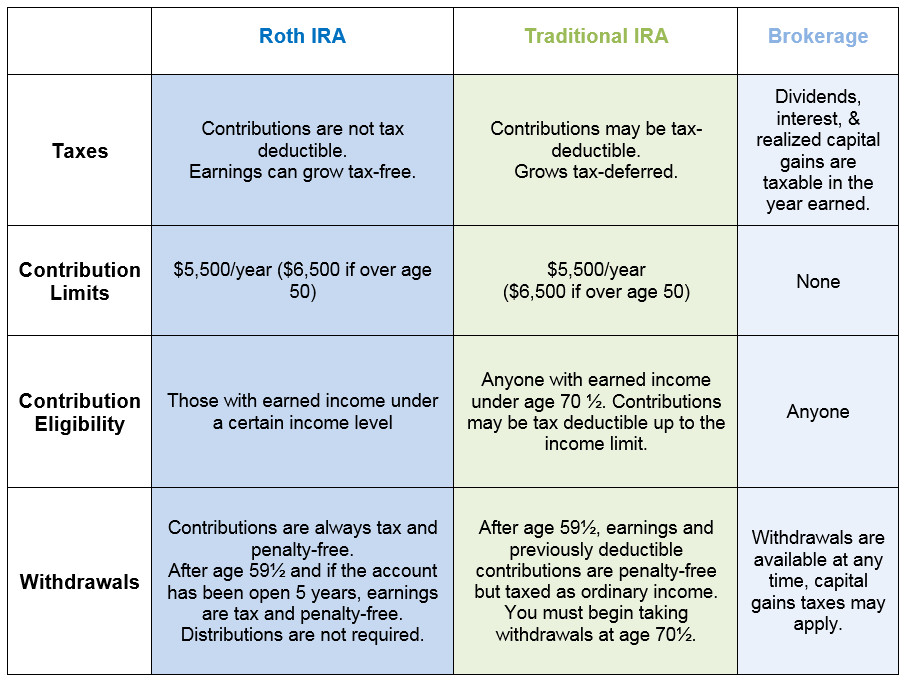

In addition to the income taxes described above those with significant income may be subject to the net investment income tax which is an additional 38 tax on top of the usual capital gains taxes. While its nice to earn money on your investments unless theyre in a retirement account you need to pay taxes on the earnings whether or not you withdraw the money from a brokerage account. For regular nonretirement investment accounts withdrawing money doesnt trigger any taxable event.

For investing and taxes capital gains generally occur when you buy a stock or other investment at one price and later sell it at a higher price. Long-term investments are subject to lower tax rates. Wed like to set additional cookies to understand how you use GOVUK remember.

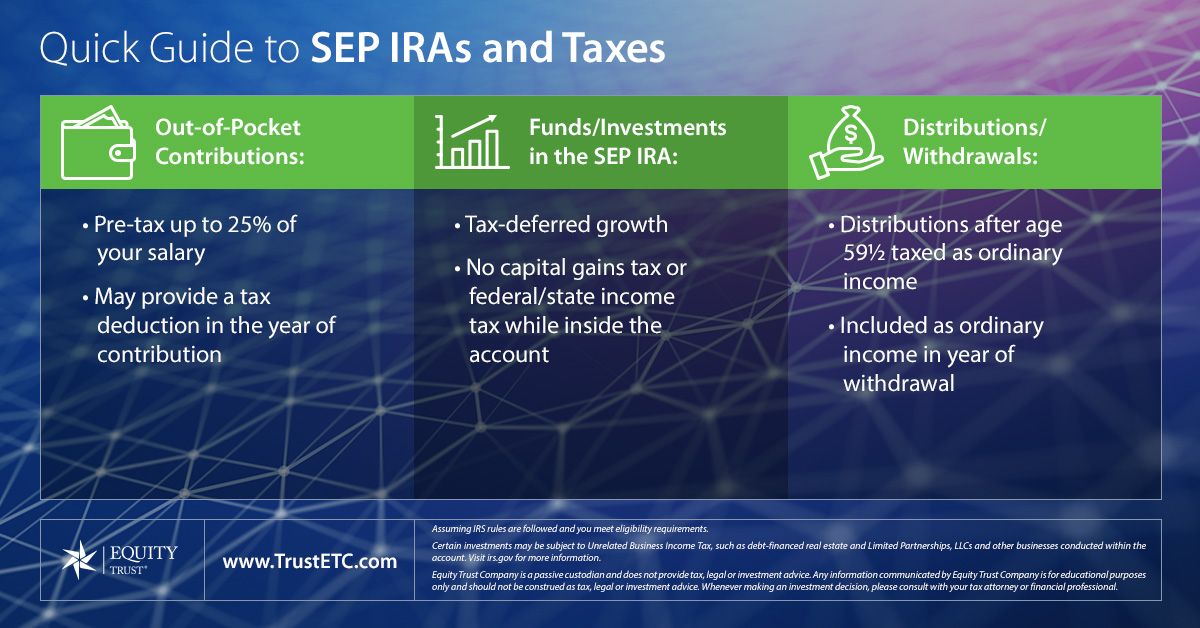

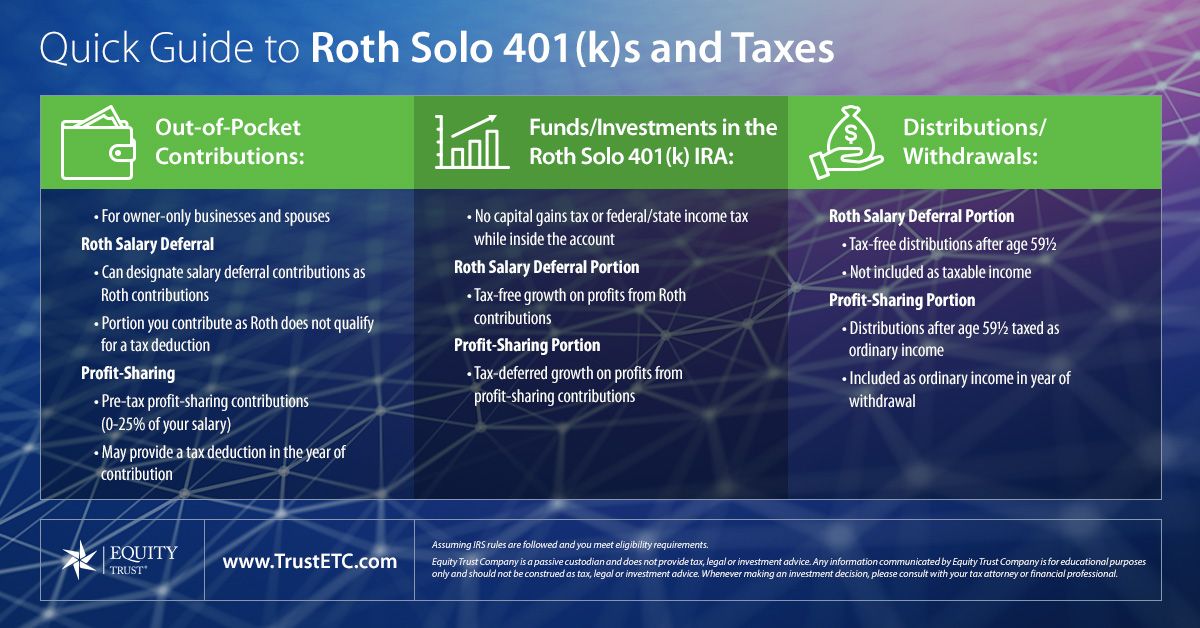

When you sell in the first year that you own the investment youll be taxed at ordinary income rates as opposed to the more favorable capital gains rate. Once money is in your 401 k and as long as the money remains in the account you pay no taxes on investment growth interest dividends or investment gains. This compounded interest and deferred tax payment benefit you most if you expect your tax bracket to be lower in the future.

Depending on your overall income tax bracket stock sales are taxed at a rate of either zero 15 20. The investment income received is deferred until the time of distribution from the plan. These limits arent currently indexed for inflation Learn more about the Medicare surtax.

If you hold an investment for. Short-Term Capital Gains Tax If youve held an asset or investment for one year or less before you sell it for a gain thats considered a short-term capital gain. The remainder is carried forward to offset next years gains.

If you hold investments in the account for at least a year youll pay the more favorable long-term capital gains rate. In the US short-term capital. Investment income may also be subject to an additional 38 tax if youre above a certain income threshold.

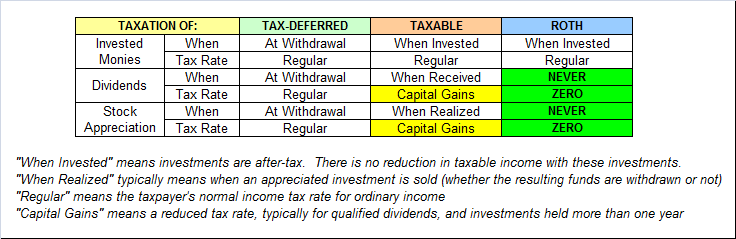

We use some essential cookies to make this website work. Tax-deferred accounts let you defer paying taxes on investment earnings until the money is withdrawn. You have a tax liability when you receive income from interest and dividends or sell your stock or other assets not when you withdraw from an investment account.

The tax rate on long-term more than one year gains is 0 15 or 20 depending on taxable income and filing status. The main types of investment income which have income tax consequences are. List of information about Tax on savings and investments.

Different types of accounts have different rules and limits. Assuming all the contributions are funded with pre-tax dollars the distributions are fully taxable as ordinary income. In general if your modified adjusted gross income is more than 200000 single filers or 250000 married filing jointly you may owe the tax.

Taxes Pay 15 Now Or 25 Later Seeking Alpha

Taxes Pay 15 Now Or 25 Later Seeking Alpha

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

Tax Deferred Vs Tax Free Investment Accounts David Waldrop Cfp

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Bank Brokerage Account Bank Now

Bank Brokerage Account Bank Now

How To Lower Your Taxes Take A Hard Look At Your Investments Napa Valley Wealth Management

How To Lower Your Taxes Take A Hard Look At Your Investments Napa Valley Wealth Management

Faqs About 3 Common Investment Accounts Level Financial Advisors

Faqs About 3 Common Investment Accounts Level Financial Advisors

The Four Different Ways The Tax Code Treats Saving And Investment Tax Foundation

The Four Different Ways The Tax Code Treats Saving And Investment Tax Foundation

Tax Free Savings Accounts Part 3

How To Invest Tax Efficiently Fidelity

How To Invest Tax Efficiently Fidelity

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

What Investments Go In Which Account For Tax Avoidance

What Investments Go In Which Account For Tax Avoidance

The Various Types Of Investment Accounts Ntellivest

The Various Types Of Investment Accounts Ntellivest

Comments

Post a Comment