Put Order Stock

Say you want to buy a long put for Oracle ORCL - Get Report stock that is currently trading at 45. This helps you control how much you spend or earn on a trade by placing points on a.

Both call and put option contracts represent 100 shares of the underlying stock.

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png)

Put order stock. In this instance youre selling the put with the intention of buying the stock after the put is assigned. There are several different methods for going about your. A put option is a contract that gives its holder the right to sell a set number of equity shares at a set price called the strike price before a certain expiration date.

A Sell Stop Order is an order to sell a stock or option at a price below the current market price. If youre moderately bearish on the stock you could buy a put at the money with a strike. If the option is.

The strike price is the set price that a put or call option can be bought or sold. Selling the put obligates you to buy stock at strike price A if the option is assigned. One of these options is called a limit order.

If you do so youre hoping that the stock will make a bearish move dip below the strike price and stay there. A Put option locks in the selling price of a stock. Put the stock to the seller if the stock declines.

If you submit a market sell order you receive the lowest price on the market. So if you buy an option with a strike price of 70 this will allow you to sell the stock for 70 anytime between the day you buy the option and when it expires. A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price.

You could also buy a put option that would give you the right to sell your stock at 100 per share any time in the next two months. When you buy a put option the seller of that option is obligated to buy. You could sell your stock getting 10300.

These order types are very different and it is. Put options are traded on various underlying assets including stocks currencies bonds. A put is a strategy traders or investors may use to generate income or buy stocks at a reduced price.

So if the stock falls to 60 your Put option will go up in value. When you submit a market order to buy a stock you pay the highest price on the market. This contrasts with a Sell Limit Order which is an order to sell a stock or option at a price above the current market price.

Of course buying stocks is also a bit more complicated than just one purchase. Stock Order Types. If the strike price of a put option is 20 and the underlying is stock is currently trading at 19 there is 1 of intrinsic value in the option.

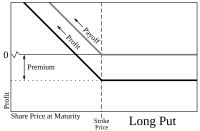

A put option is bought if the trader expects the price of the underlying to fall within a certain time frame. You can exercise your option at any time before the expiration date. Selling put options is one of the most flexible and powerful tools for generating income and entering stock positions.

When managing your stock market trades many techniques and methods exist to help you make a profit or reduce a loss. The buyer of a put option may sell or exercise the underlying asset at a specified strike price. A stop-loss is designed to limit an investors loss on a security.

But the put option may trade for 135. When writing a put the writer agrees to buy the underlying stock at the strike price if the. When a market order is received it essentially cuts in line ahead of pending orders and gets the highest or lowest price available.

Rather than buying shares at whatever the market currently offers you can calculate exactly what youre willing to pay for them and then sell the put. When running this strategy you may wish to consider selling the put slightly out-of-the-money.

Put Option Explained Online Option Trading Guide

Put Option Explained Online Option Trading Guide

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png) Call And Put Options What Are They

Call And Put Options What Are They

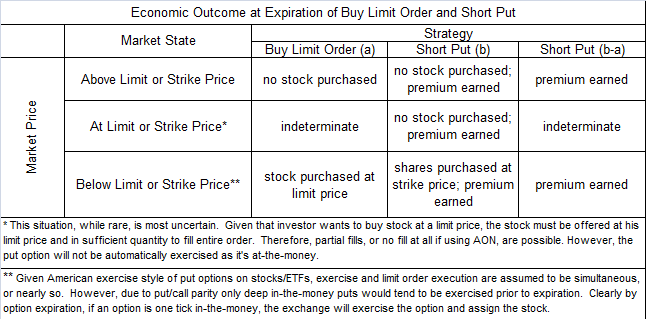

Are Short Equity Puts Economically Equivalent To Buy Limit Orders Long Tail Of Finance Seeking Alpha

Are Short Equity Puts Economically Equivalent To Buy Limit Orders Long Tail Of Finance Seeking Alpha

The Three Steps Of Placing Orders In Philippines Stock Market With Col Financial Citiseconline Online Stockbroker Smart Pinoy Investor Investing And Personal Finance

The Three Steps Of Placing Orders In Philippines Stock Market With Col Financial Citiseconline Online Stockbroker Smart Pinoy Investor Investing And Personal Finance

5 Best Order Types For Stock Trading Stocktrader Com

5 Best Order Types For Stock Trading Stocktrader Com

Market Stop Loss Or Stop Limit Know When To Use Which Order For Stocks The Financial Express

Market Stop Loss Or Stop Limit Know When To Use Which Order For Stocks The Financial Express

/call-and-put-options-definitions-and-examples-1031124-v5-8566395195f0403aaf5b4ad9e5cc9364.png) Call And Put Options What Are They

Call And Put Options What Are They

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

/dotdash_Final_Put_Option_Jun_2020-01-ed7e626ad06e42789151abc86206a1f3.jpg)

Comments

Post a Comment