Prevailing Wage Ny

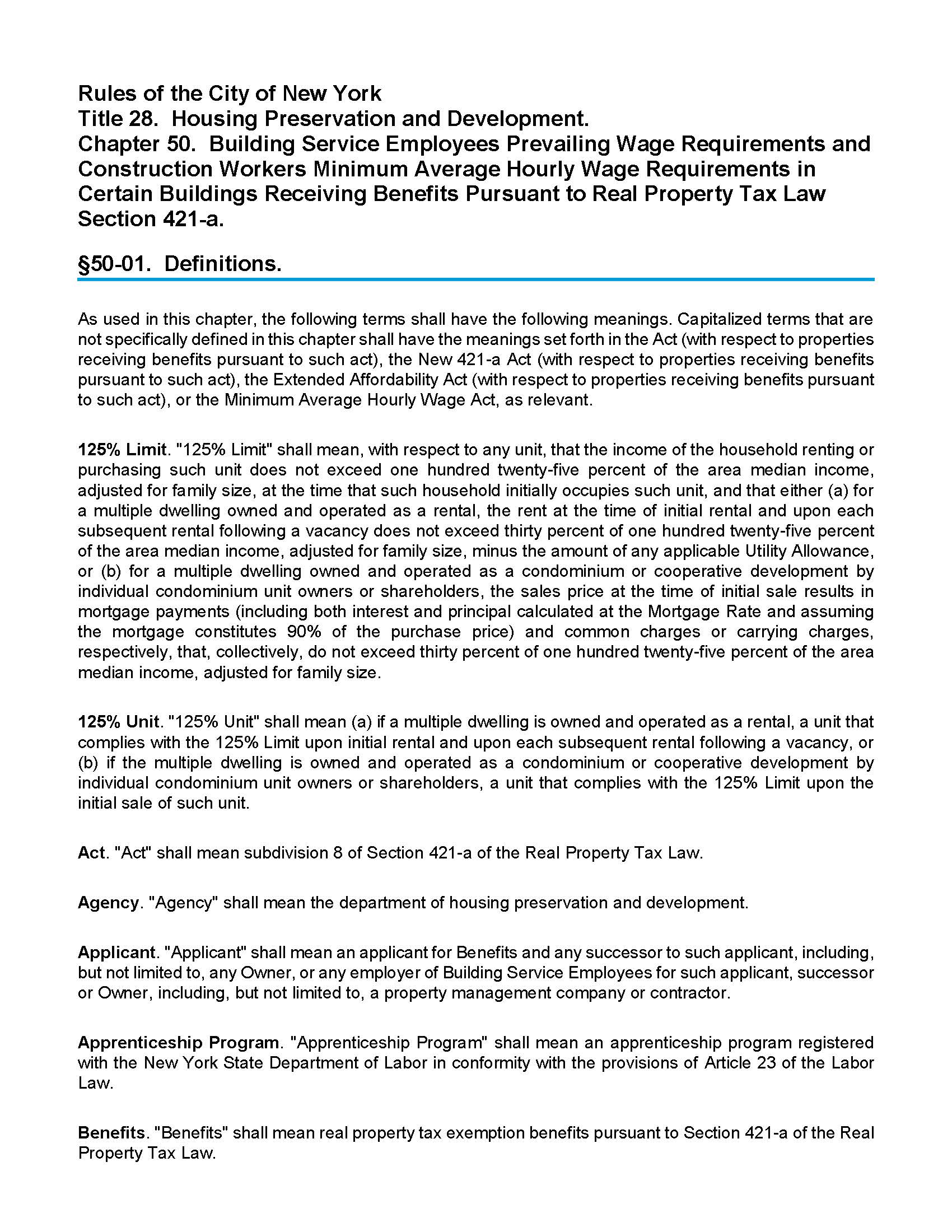

While previously the payment of prevailing wages had been reserved for public construction projects only the new bill expands the prevailing wage requirement to certain private projects for the first time in our states. All contractors and subcontractors are required to pay the current prevailing rates of wages and supplements.

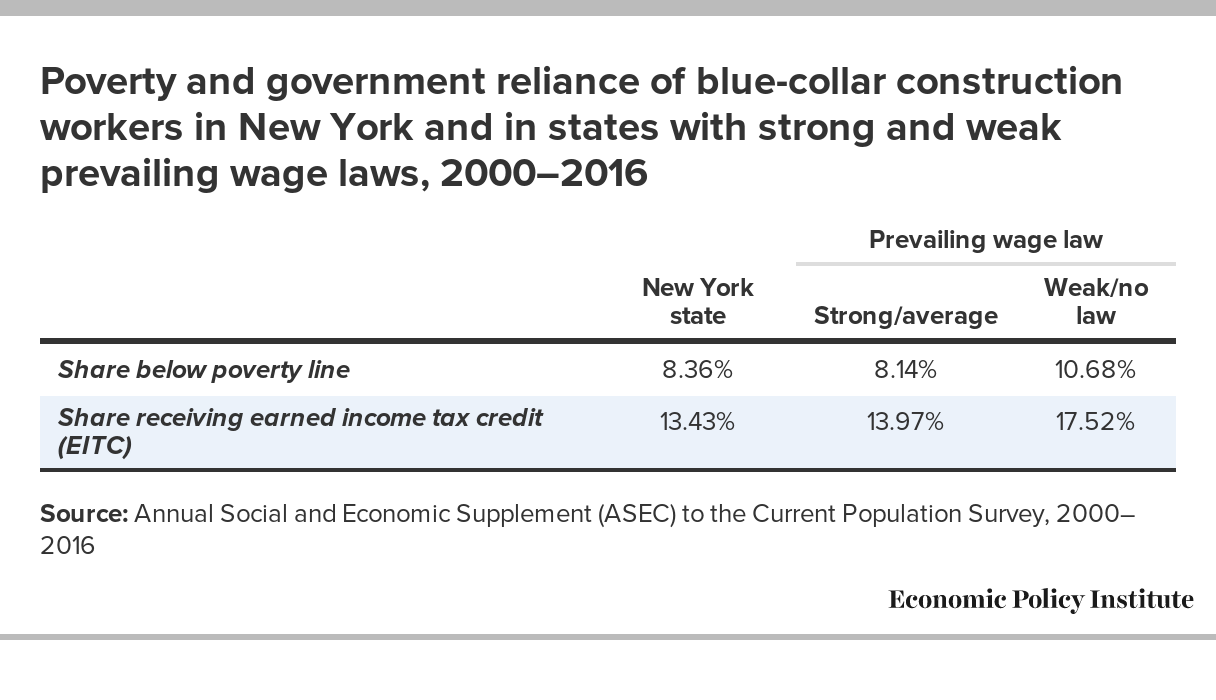

New York S Prevailing Wage Law A Cost Benefit Analysis Economic Policy Institute

New York S Prevailing Wage Law A Cost Benefit Analysis Economic Policy Institute

Prevailing Wage The Labor Law requires public work contractors and subcontractors to pay laborers workers or mechanics employed in the performance of a public work contract not less than prevailing rate of wage and supplement fringe benefits in the locality where the work is performed.

Prevailing wage ny. So what is prevailing wage and how does it work. Search Article 8 Prevailing Wage Schedules Schedule Type. New York State Labor Law does not require a minimum monetary threshold amount that must be met for application of prevailing wage regulations to public works projects.

Determination which takes effect on July 1 of each year. Determination which takes effect on July 1 of each year. Tenant and lease agreements to comply with the prevailing.

New York State Labor Law also mandates prevailing wages for all building service workers. Prevailing wage is the minimum wage rate that a worker on a government project must be paid. Public works projects are defined as projects for local and state governments that are paid either in full or.

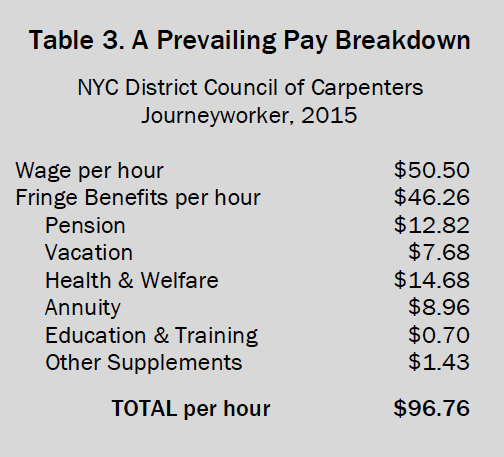

Prevailing wages are the hourly wages a worker is compensated for specific types of labor in a certain area of a public works project and generally include fringe benefits such as overtime and holiday pay. The Bureau of Public Work administers Articles 8 and 9 of the New York State Labor Laws. To send the reply to someone other than the agency contact such as the architect please complete the section below.

The Labor Law requires public work contractors and subcontractors to pay a service employee under a contract for building service work for a public agency a wage of not less than the prevailing wage and supplements fringe benefits in the locality for the craft trade or occupation of the service employee. This applies to all laborers workers or mechanics employed under a public work contract. If you have any questions please contact the Bureau of Public Work or visit the New York State Department of Labor website wwwlaborstatenyus for current wage rate information.

New York Prevailing Wage Laws. Mailed to the address specified. The State Department of Labor establishes prevailing wages for most localities but in New York City they are determined by the Citys Office of the Comptroller.

Forth in the New York State Constitution. The Labor Law requires public work contractors and subcontractors to pay laborers workers or mechanics employed in the performance of a public work contract not less than prevailing rate of wage and supplement fringe benefits in the locality where the work is performed. April 15 2021 119 pm COVID-19 Updates.

There are many factors to consider when paying someone prevailing wage. NYS Department of Labor - Prevailing Wages Search NYGov - navigation embed. On April 3 2020 New York lawmakers passed a 177 billion budget bill that significantly expanded the application of prevailing wages on construction projects in the state.

County You may also select either an Occupation from the dropdown below OR enter a keyword. If you have any questions please contact the Bureau of Public Work or visit the New York State Department of Labor website wwwlabornygov for current wage rate information. Its not as simple as paying a retail worker the minimum wage.

07012020 Piledriver 5593 Dockbuilder 5593 Page 3 Prevailing Wage Rates for 07012020 - 06302021 Published by the New York State Department of Labor Last Published on Apr 01 2021 Westchester County. Prevailing wage is the wage and benefit rate set annually by the New York City Comptroller for each trade or occupation for employers performing public works projects and building service work on New York City government-funded work sites. These regulations also include holiday pay and cash equivalencies for various fringe employment benefits that are considered to be required under the prevailing wage law.

TIMING AND INCREASES The prevailing rate of wages and supplements are determined annually on July 1 of each year and are effective through June 30 ie. July 1 2001 June. Prevailing wage is the pay rate set by law for work on public work projects.

All contractors and subcontractors are required to pay the current prevailing rates of wages and supplements. Wear a mask social distance and stay up to date on New York States vaccination program. COVID-19 is still spreading even as the vaccine is here.

The New York State Department of Labor and the United States Department of Labor publish detailed schedules of prevailing wages on a county-by-county and trade-by-trade basis. The rate differs depending on the task. Bronx Kings Nassau New York Putnam Queens Richmond Rockland Suffolk Westchester WAGES Per hour.

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

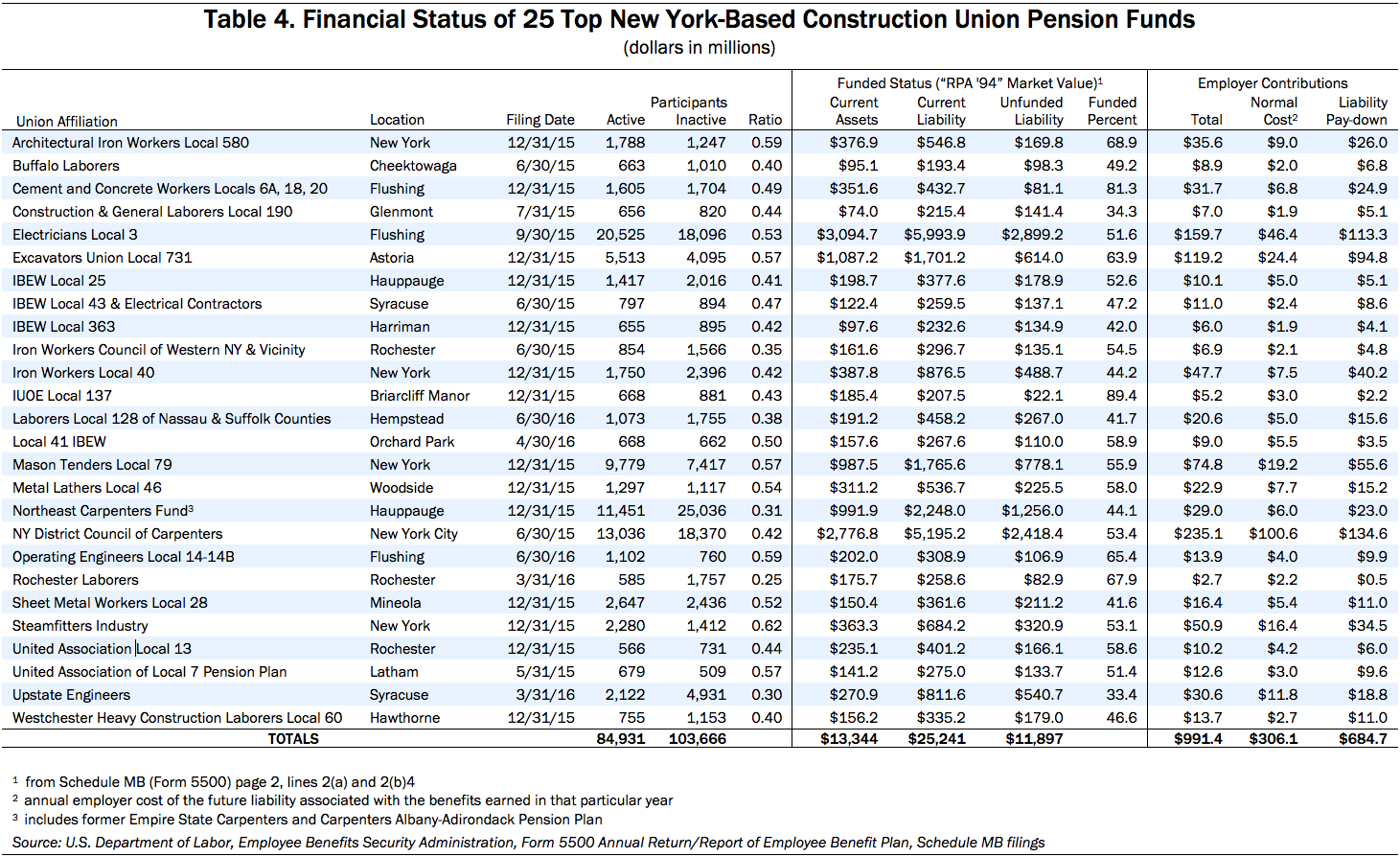

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

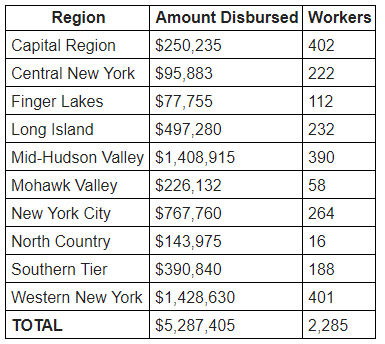

Governor Cuomo Announces More Than 5 Million In Prevailing Wage Underpayments Recovered In First Half Of 2017

Governor Cuomo Announces More Than 5 Million In Prevailing Wage Underpayments Recovered In First Half Of 2017

Prevailing Waste Empire Center For Public Policy

Prevailing Waste Empire Center For Public Policy

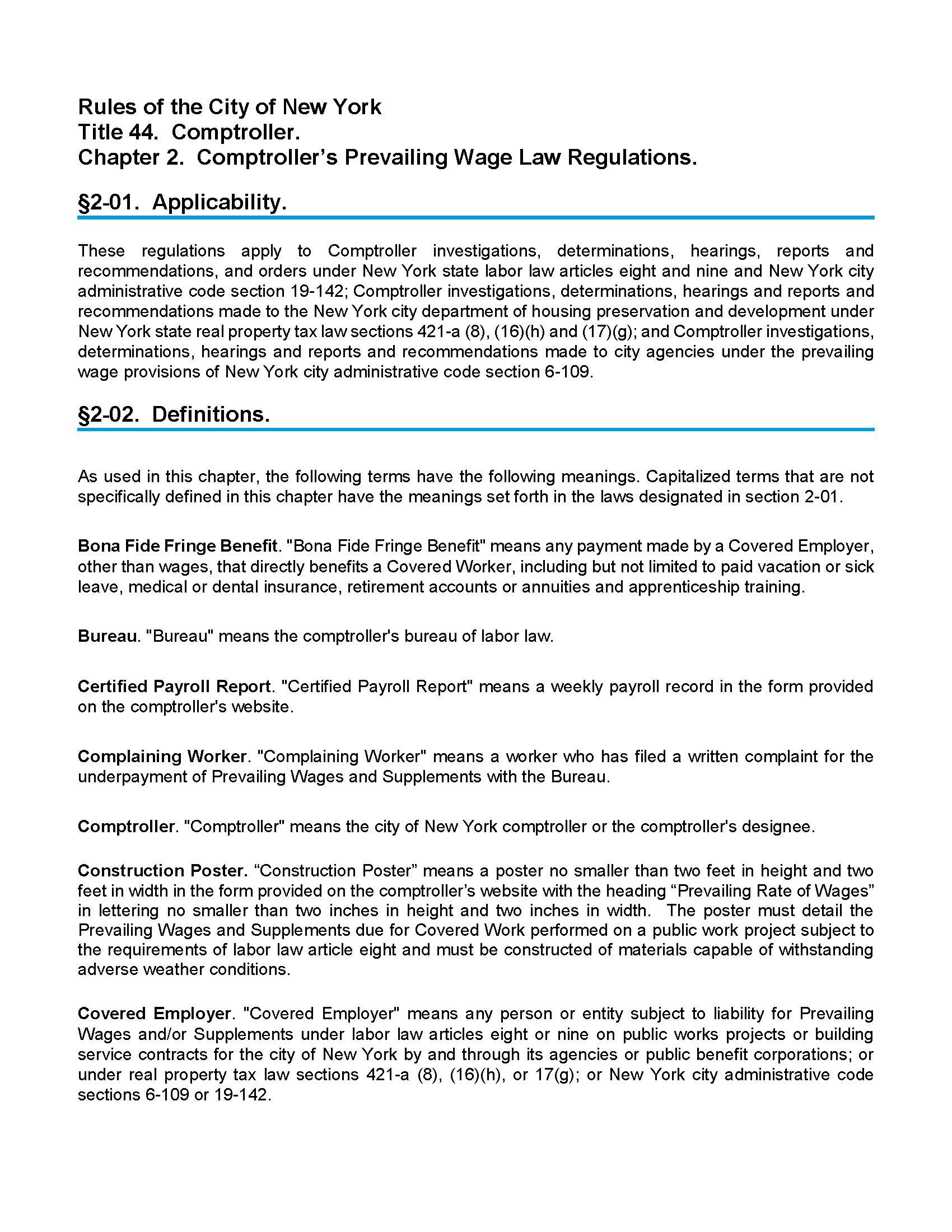

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

Wage Schedules Office Of The New York City Comptroller Scott M Stringer

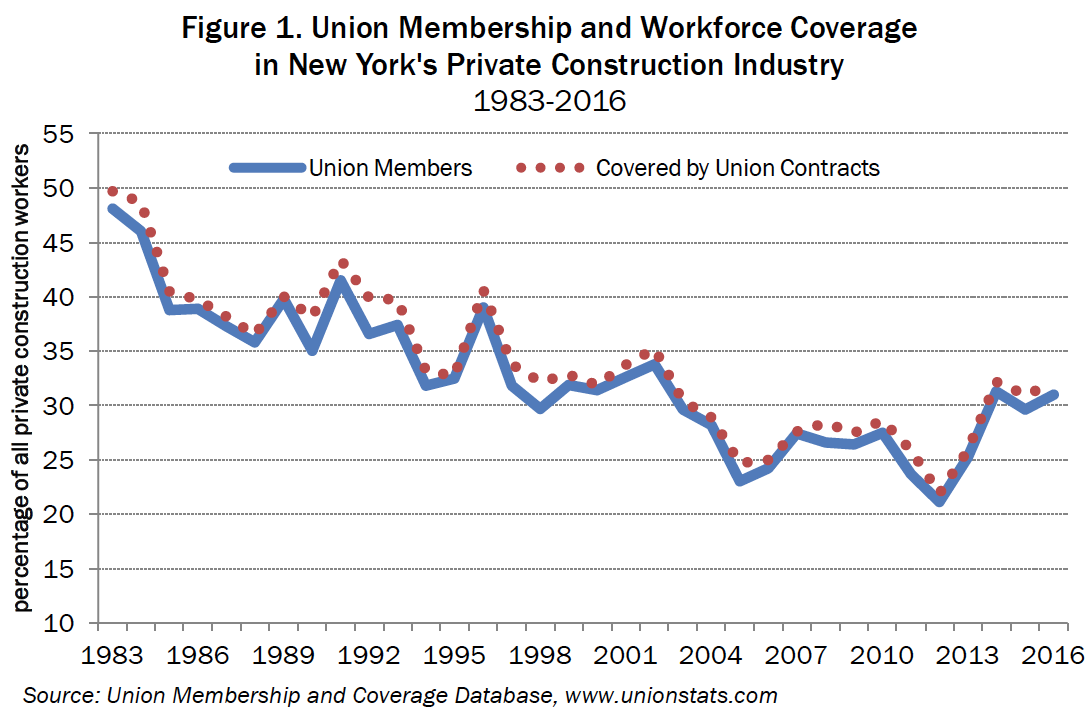

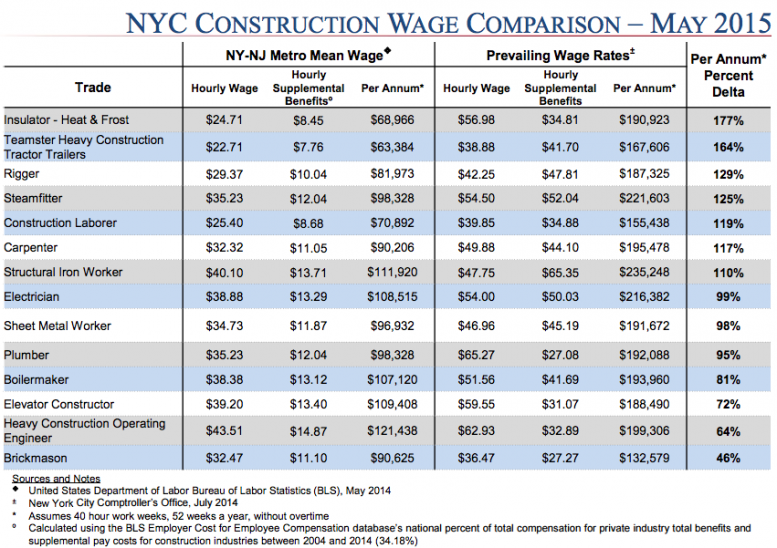

Construction Workers On Nyc S Public Projects Make Up To 177 More Than Private Industry Counterparts New York Yimby

Construction Workers On Nyc S Public Projects Make Up To 177 More Than Private Industry Counterparts New York Yimby

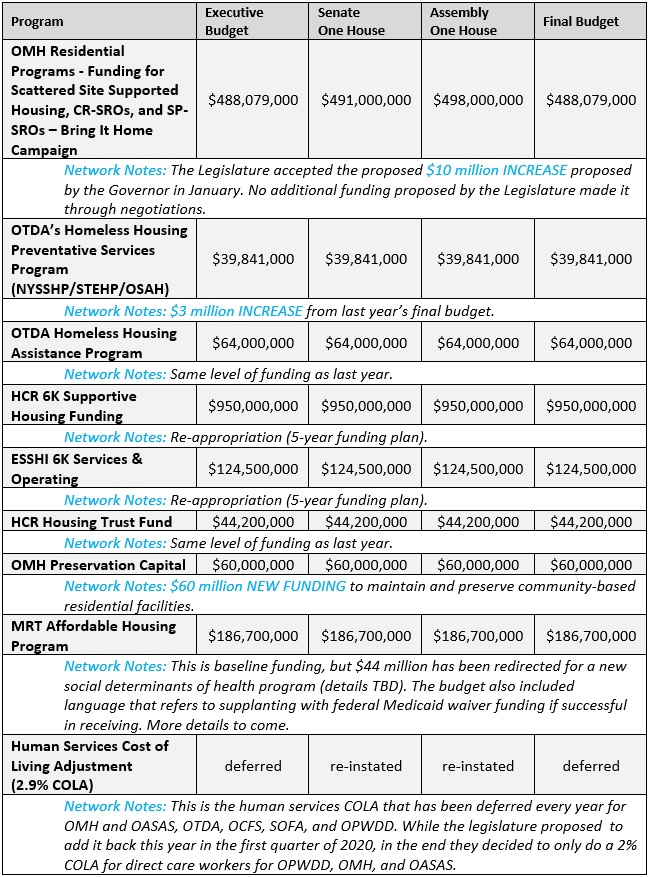

The Network Offers Analysis Of The Final Nys 2019 2020 Budget Network Newsfeed Supportive Housing Network Of New York

The Network Offers Analysis Of The Final Nys 2019 2020 Budget Network Newsfeed Supportive Housing Network Of New York

Prevailing Wage Laws By State Download Table

Prevailing Wage Laws By State Download Table

Comments

Post a Comment