Ny State Sales Tax Rate 2020

This rate includes any state county city and local sales taxes. The Brooklyn sales tax rate is.

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

New York State Sales and Use Tax Rates by Jurisdiction - Publication 718 - Effective August 1 2019 Updated.

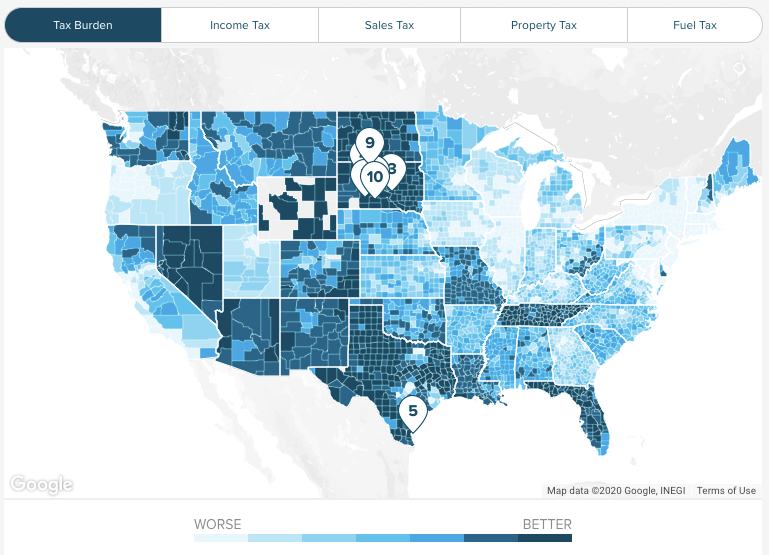

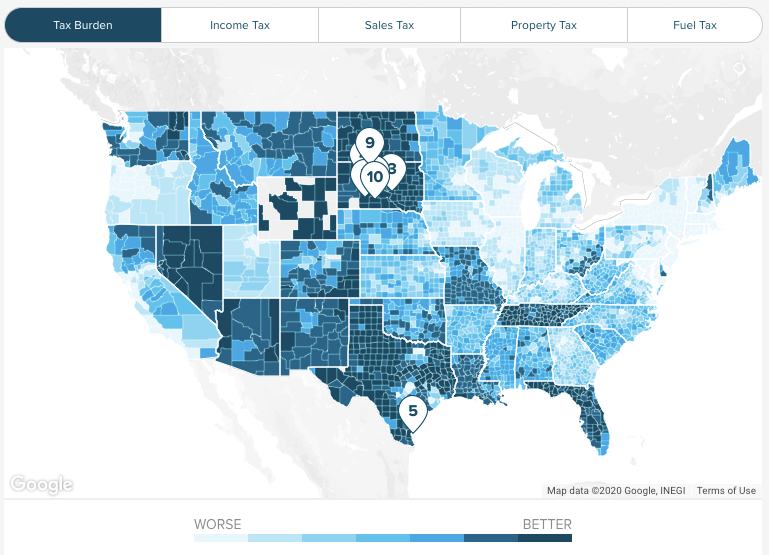

Ny state sales tax rate 2020. 48 rows Wondering what your state sales tax rate is. Total State and Local Sales Tax Rate 70 75 80 Between 80 and 85 More than 85 Understanding Local Government Sales Tax in New York State Industrial Development Agencies2020 Update5 Currently 18 cities impose their own sales tax. This rate includes any state county city and local sales taxes.

888 is the highest possible tax rate New York City New York The average combined rate of every zip code in New York is 7959. The County sales tax rate is. Sales tax rates and identifying the correct local taxing jurisdiction.

Counties and cities can charge an additional local sales tax of up to 4875 for a maximum possible combined sales tax of 8875. Ad Find What You Need At BookingCom The Biggest Travel Site In The World. The latest sales tax rate for Brooklyn NY.

Click here for a larger sales tax map or here for a sales tax table. Combined with the state sales tax the highest sales tax rate in New York is 8875 in the cities. The five states with the highest average combined state and local sales.

Use tax applies if you buy tangible personal property and services outside the state and use it within New York State. The New York sales tax rate is currently. This is the total of state county and city sales tax rates.

The New York sales tax rate is 0. The 8 sales tax rate in Kingston consists of 4 New York state sales tax and 4 Ulster County sales tax. This is the total of state county and city sales tax rates.

The New York City sales tax rate is much higher at 8875 percent including the state sales tax rate a city sales tax rate of 45 percent and the Metropolitan Commuter Transportation District surcharge of 0375 percent. Groceries prescription drugs and non-prescription drugs are exempt from the New York sales tax. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district.

Local sales taxes are collected in 38 states. There is no applicable city tax or special tax. The latest sales tax rate for Whitestone NY.

Easy Fast And Secure Booking With Instant Confirmation. The County sales tax rate is. Here youll find a handy guide to.

For information on the Oneida Nation Settlement Agreement see Oneida Nation Settlement Agreement. The minimum combined 2021 sales tax rate for Rochester New York is. 2020 rates included for use while preparing your income tax deduction.

The sales tax jurisdiction name is Kingston City which may refer to a local government division. In some cases they can rival or even exceed state rates. The Rochester sales tax rate is.

An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. Sales tax applies to retail sales of certain tangible personal property and services. This is the total of state county and city sales tax rates.

Sales tax rates. Ad Find What You Need At BookingCom The Biggest Travel Site In The World. The New York sales tax rate is currently 4.

January 30 2020 Department of Taxation and Finance. 1652 rows New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 4229. But there are ways to get around sales taxes in New York City.

The New York sales tax rate is currently. Easy Fast And Secure Booking With Instant Confirmation. State and Local Sales Tax Rates 2020 Key Findings Forty-five states and the District of Columbia collect statewide sales taxes.

New York New York sales tax rate details. The County sales tax rate is 4. The New York state sales tax rate is 4 and the average NY sales tax after local surtaxes is 848.

No changes Has been made in New York for county city andor special rates in current quarter of 2021 compared. The minimum combined 2021 sales tax rate for Brooklyn New York is. The minimum combined 2021 sales tax rate for New York New York is 8.

2020 rates included for use while preparing your income tax deduction. You can print a 8 sales tax table here.

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

New York Sales Tax Rate Rates Calculator Avalara

Washington S Combined State Local Sales Tax Rate Ranks 5th In The Nation Opportunity Washington

Washington S Combined State Local Sales Tax Rate Ranks 5th In The Nation Opportunity Washington

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

State Sales Tax Rates Sales Tax Institute

State Sales Tax Rates Sales Tax Institute

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Which States Require Sales Tax On Clothing Taxjar Blog

Which States Require Sales Tax On Clothing Taxjar Blog

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

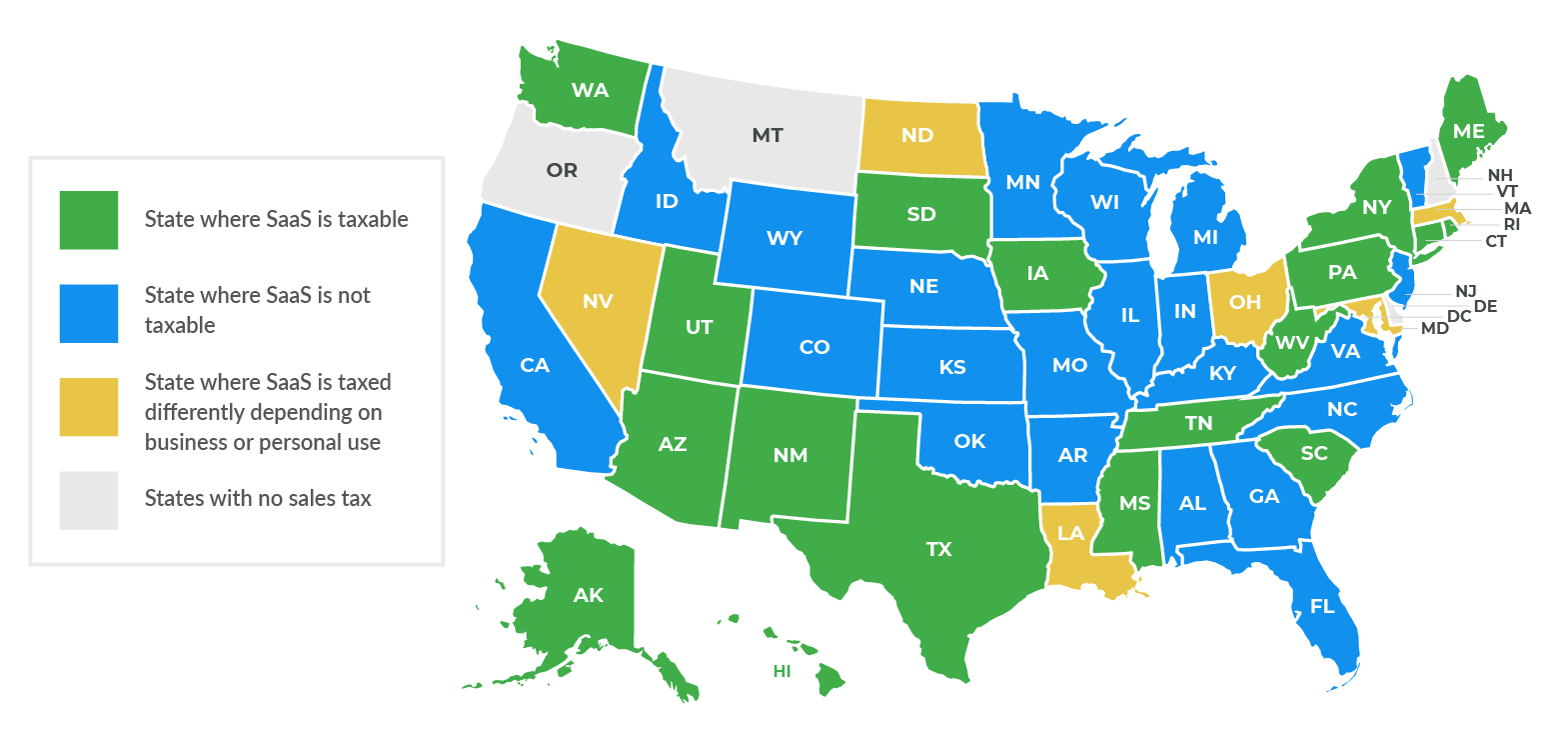

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

New York Budget Gap Options For Addressing New York Revenue Shortfall

New York Budget Gap Options For Addressing New York Revenue Shortfall

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Comments

Post a Comment