Ny State Income Tax Brackets 2020

New York States top marginal income tax rate of 882 is one of the highest in the country but very few taxpayers pay that amount. Married filing jointly or qualified widower 4.

Single or married filing separately.

Ny state income tax brackets 2020. 962 New York City is 425 Yonkers resident is 161135 and Yonkers nonresident is 050 North Carolina. NYS adjusted gross income is MORE than 107650. Check the 2020 New York state tax rate and the rules to calculate state income tax.

The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. Its our no-cost way to easily complete and file your federal and New York State income tax returns online. Rates kick in at different income levels depending on your filing status.

NYS tax rate schedule. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Find your gross income.

New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. AND NYS taxable income is 65000 or MORE. New York City has four tax brackets ranging from 3078 to 3876.

New York Income Taxes. Indexing of the brackets was frozen at 2018 levels for tax years 2019 and 2020 but is set to resume in 202111. Find your income exemptions.

2020 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. How to Calculate 2020 New York State Income Tax by Using State Income Tax Table. New York State Tax.

New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. In addition beginning in tax year 2020 the state now offers a bracket adjustment providing a scaled deduction for taxpayers with income of more than 79300 but less than or equal to 84600. Each year the state of New York publishes new Tax Tables for the new tax year the New York Tax Tables are published by the New York State Government.

For your 2020 taxes which youll file in early 2021 only individuals making more than 1077550 pay the top rate and earners in the. To be sure you arent charged a fee access the Free File software thats right for you directly. Each of these tax tables contains rates and thresholds for business tax in New York corporation tax in New York employer tax in New York employee tax in New York property tax in New York sales tax in New York and other tax rates.

The New York State State Tax calculator is updated to include the latest State tax rates for 20212022 tax year and will be update to the 20222023 State Tax Tables once fully published as published by the various States. AND NYS taxable income is LESS than 65000. Find your pretax deductions including 401K flexible account contributions.

Applicable in addition to all state taxes. NYS adjusted gross income is 107650 or LESS. New York state income tax rates.

Prepare and file your income tax return with Free File. The states seven individual income tax brackets were consolidated into five with the first two brackets eliminated and each of the remaining marginal rates was reduced by 4 percent. If your 2020 income was 72000 or less youre eligible to use Free File income tax software.

The state applies taxes progressively as does the federal government with higher earners paying higher rates. For more information see Free File your income tax return. 9 rows New York State Standard Deduction 2020 New York is one of the wealthiest.

Use the NYS tax computation. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. NYS taxable income LESS than 65000.

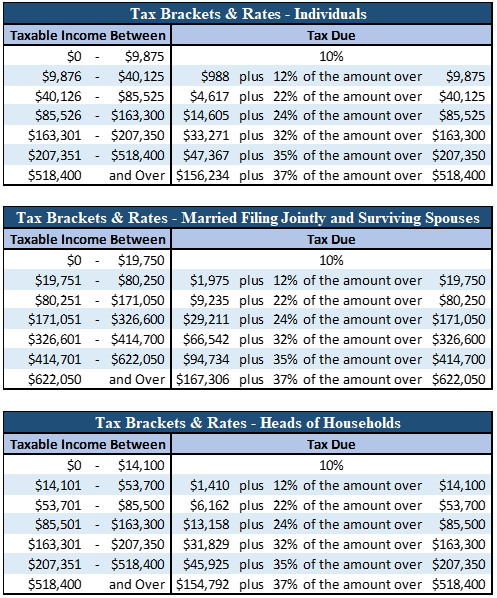

Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. Federal Income Tax - Minimum Bracket 10 Maximum Bracket 396. The New York State State Tax calculator is updated to include the latest Federal tax rates for 2015-16 tax year as published by the IRS.

New York City Resident Tax.

2020 2021 Federal Tax Brackets And Rates Bankrate

2020 2021 Federal Tax Brackets And Rates Bankrate

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

What You Need To Know About 2020 Taxes Advisors Management Group

What You Need To Know About 2020 Taxes Advisors Management Group

Http Nysac Membershipsoftware Org Files Nysactaxwhitepaper 1 Pdf

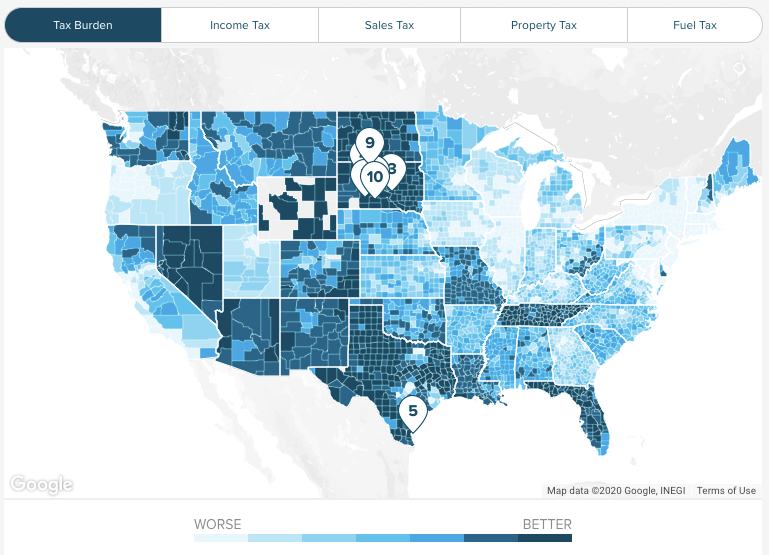

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Do States Like New York And California Really Have High Taxes Quora

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Comments

Post a Comment