Vantagescore 3.0 Vs Fico 8

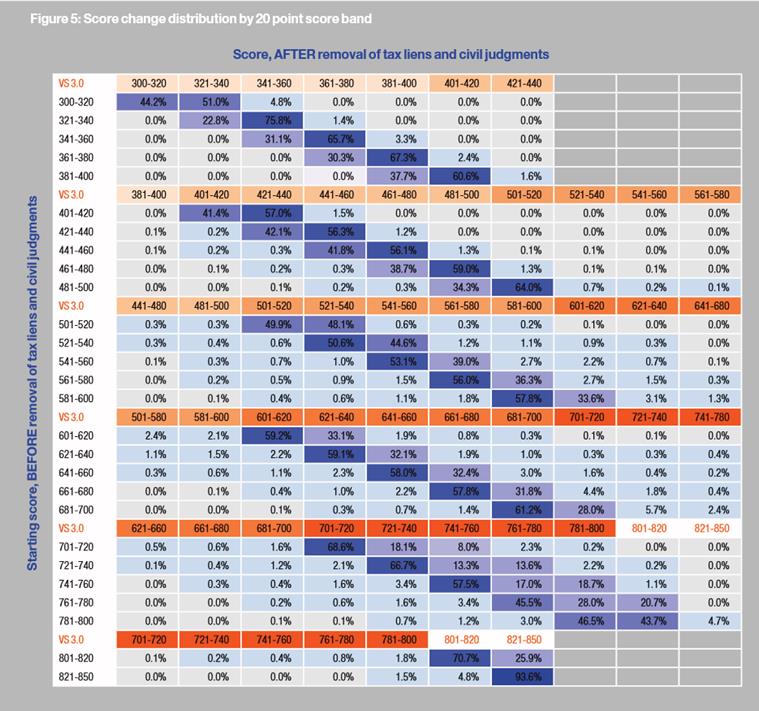

Below are three Vantage Score 30 vs FICO credit score 8 comparison charts for TransUnion Experian and Equifax. Scores Issued per Year.

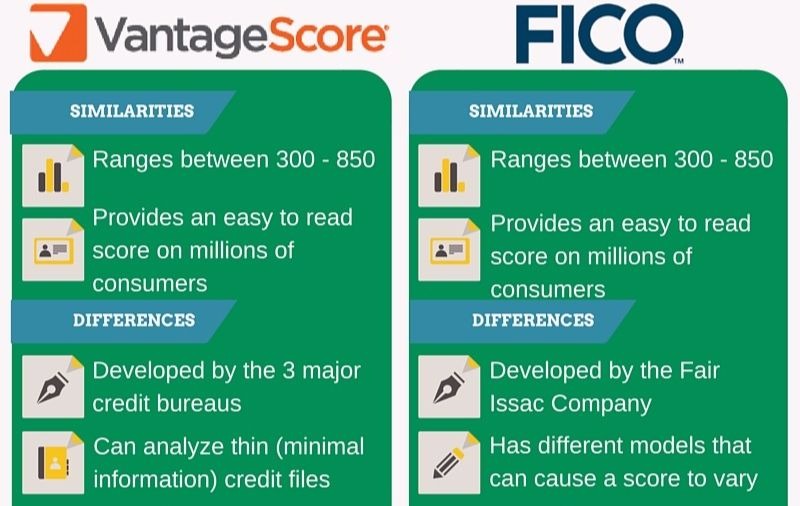

VantageScore was developed in 2006 by a collaborative effort of the three credit reporting agencies.

Vantagescore 3.0 vs fico 8. Share of Lenders Using Score. The tiers and ranges didnt change from 30. Today both VantageScore 30 and FICO 8 are the most commonly used scoring models.

FICO is considered the standard in credit scoring trusted by lenders for decades. What qualifies as a good score can vary from one creditor to another. 80 of the 25 largest lenders.

This complicates direct translation from one scoring system to another because they work on different assumptions and methodologies. The first two versions of the VantageScore ranged from 501 to 990 but the latest VantageScore 30 and 40 use the same 300-to-850 range as base FICO scores. As a result VantageScore versus FICO Score conversion was necessary for both consumers and lenders to understand the.

There are multiple versions of each score. Similar but different is the conclusion when comparing VantageScore and FICO. The current VantageScore 30 was introduced in 2013 when they adjusted their scoring system to match FICOs range of 300 - 850 for credit scores.

For the older VantageScore 10 and 20 models the credit score scale ran from 501 to 990. Touted as a consumer-friendlier scoring model more than 2200 financial institutions used more than 6 billion VantageScore credit scores from July 2016 to June 2017 according to research firm Oliver Wyman. Popular versions used by lenders today include FICO 8 launched in 2004 and FICO 9 launched in 2014.

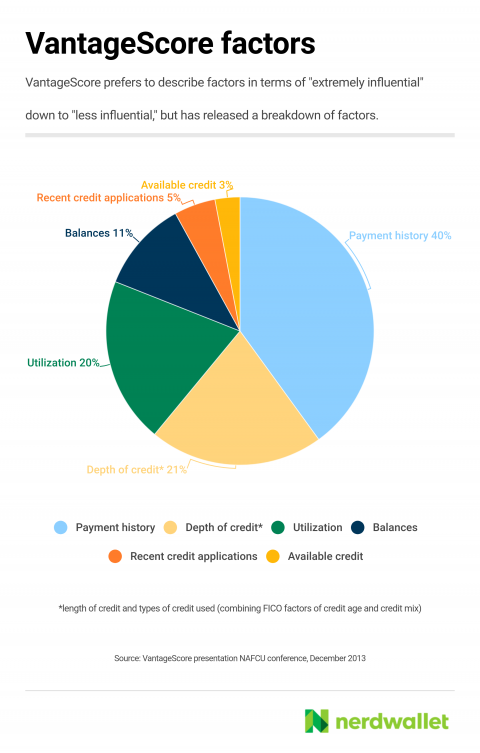

Now with FICO Score 8 as long as the late payment is a one-time deal and your other accounts are in good standing you wont be impacted as much. The VantageScore 30 model places a heavier emphasis on age of accounts then the FICO Score 8 model as well as incorporating payment information from other sources like utility companies. But heres a general breakdown for scores ranging from 300-850 according to Equifax and Experian.

Each lender has its own criteria for what it considers to be good and it can also vary by credit scoring model. The latest version of VantageScore 40 was released in April 2017. The latest VantageScore 30 comes with the same scoring range both vary from 300 to 850 points.

The 300 to 850 range is an established standard and the desire for greater market penetration was a factor in VantageScores range adjustment in version 30. While FICO used a credit range of 300 to 850 VantageScore chose 501 to 990. 90 of the 100 largest lenders.

However VantageScore 30 and 40 adopted the same 300 to 850 scale that FICO uses. And it continues today with VantageScore 40 making it easier for consumers to compare their VantageScore and FICO credit scores. Recent Credit Experience Needed for Score.

We recommend Credit Sesame. With the 40 release VantageScore says it uses machine learning techniques to find patterns in the credit data and provide more accurate scores to this segment of the population. There are many documented differences between the two scores.

Both FICO 8 and FICO 9 disregard collections when the original balance was less than 100. While most lenders still use your FICO score there is no denying that your VantageScore is still effective. This is much different from what VantageScore offered before with ratings ranging from 501 to.

The most recent FICO Score version is 9 but 8 is used more often as of February 2020. The older VantageScore 20 has a 501 to 990 range. As with Fico 8 VantageScore 30 has a range from 300 to 850.

For instance across the three credit bureaus FICO Auto Score 8 is widely used in auto financing mortgage lenders often rely on FICO Scores 2 FICO Score 4 and FICO Scores 5 and credit card issuers tend to check FICO Bankcard Score 8 or FICO Score 8. Many credit scores today including the base FICO credit scores and VantageScore 30 and 40 have a range of 300-850. VantageScore 30 and 40 scoring models can score about 30 million to 35 million consumers who cant obtain a credit score from other models.

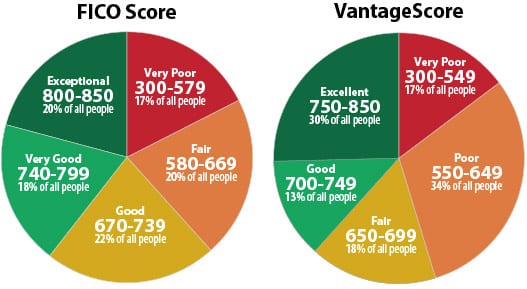

FICO also creates separate scores specifically for auto loans credit cards and mortgages. The FICO Score system qualifies 58 percent of the US. FICO Score 8 does not factor in small-dollar collection accounts with an original balance of less than 100.

Yet just because FICO or VantageScore releases a new credit score doesnt mean that every lender will. VantageScore 30 and 40 are similar to FICO 9 in that they dont count paid collection accounts and assign less importance to medical collections but they do not make exceptions for collections with low balances. Inquiry Grouping Period 14 days.

The most popular models used are FICO 8 and the all new VantageScore 30 which ACUTRAQ Background Screening uses. Population for good or excellent credit ratings whereas Vantage Scores top two categories encompass only 36 percent of the population. That changed when VantageScore 30 was released with a range of 300 to 850.

How To Get A Free Fico Credit Score From All 3 Credit Bureaus

How To Get A Free Fico Credit Score From All 3 Credit Bureaus

Vantagescore Vs Fico Score 4front Credit Union

Vantagescore Vs Fico Score 4front Credit Union

What Is The Average Credit Score In America Credit Com

What Is The Average Credit Score In America Credit Com

What Is A Vantagescore Nerdwallet

What Is A Vantagescore Nerdwallet

Credit Scoring For Mortgage Loans White Jacobs Credit Repair

Credit Scoring For Mortgage Loans White Jacobs Credit Repair

My Vantagescore 3 0 Vs Fico Credit Score 8 Comparison Charts

My Vantagescore 3 0 Vs Fico Credit Score 8 Comparison Charts

My Vantagescore 3 0 Vs Fico Credit Score 8 Comparison Charts

My Vantagescore 3 0 Vs Fico Credit Score 8 Comparison Charts

Is Transunion Credit Score Accurate Vantagescore Vs Fico Badcredit Org

Is Transunion Credit Score Accurate Vantagescore Vs Fico Badcredit Org

What Is A Good Credit Score Experian

What Is A Good Credit Score Experian

Know Your Credit Risk Score Options Vantagescore 3 0 Vs Fico 8

Know Your Credit Risk Score Options Vantagescore 3 0 Vs Fico 8

Vantage Score Vs Fico Score What S The Difference

Vantage Score Vs Fico Score What S The Difference

Comments

Post a Comment