How Much Can You Make With Social Security

The Social Security earnings limits are established each year by the SSA. Furthermore if youll be reaching FRA in 2021.

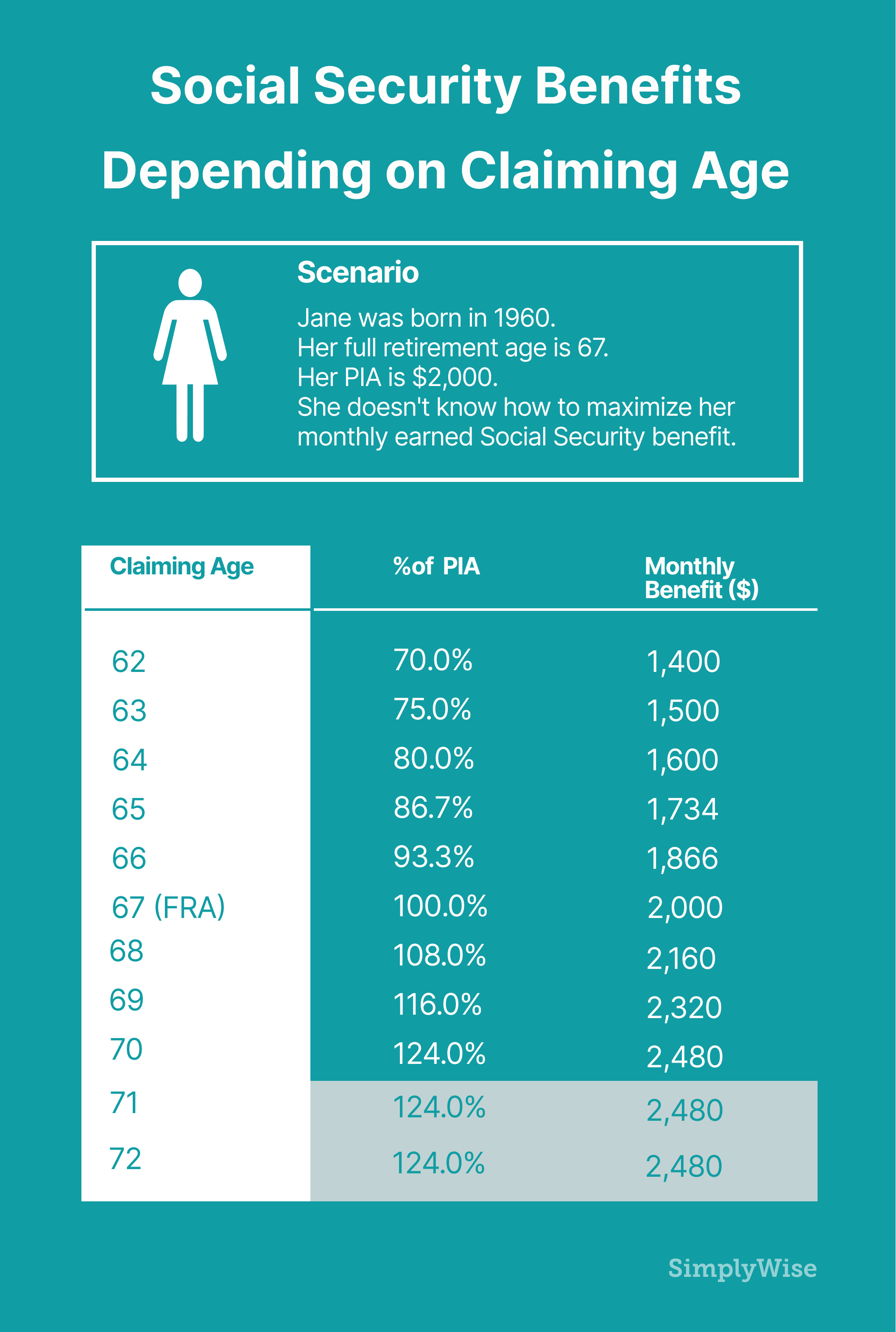

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

9600 - 5000 4600 Reach full retirement age in.

How much can you make with social security. The maximum possible Social Security benefit for someone who retires at. However your retirement age and income amount determine whether you receive 100. Youll get that 3380 back eventually.

For married couples filing jointly you will pay taxes on up to 50 of your Social Security income if you have a combined income of 32000 to 44000. Once you earn more than the limit Social Security deducts 1 from your benefits for every 2 you earn. According to Social Security the earnings limit if you retire mid year the year before your full retirement year you can only make 1420 per month not the total of 1420 times the number of months remaining int the year you retired.

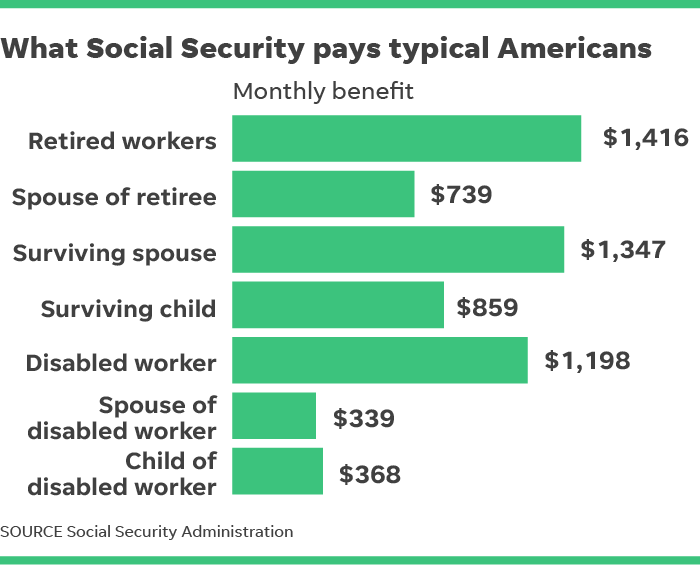

The average Social Security benefit was 1543 per month in January 2021. How Much Can I Earn. When you retire you can still choose to work while receiving benefits from the Social Security Administration.

You would receive 4600 of your 9600 in benefits for the year. Total monthly income 300 Social Security benefit 1 300 Social Security benefit -20 Not counted 280 Countable income 2 794 SSI Federal benefit rate -280 Countable income 514 SSI Federal benefit EXAMPLE B SSI Federal Benefit with only EARNED INCOME. Benefit estimates depend on your date of birth and on your earnings history.

Any income above that is not counted in your benefit calculation and is also not subject to Social Security taxes. Updated December 23 2020. In 2019 the annual earnings limit for those achieving full retirement age in 2020 or later was 17640.

That means youre 6760 over the earnings test limit for your age in which case youll have half that amount -- 3380 -- in benefits withheld. Social Security sets a cap on how much of your income it takes into account in figuring your benefit. Once an individual reaches full retirement age currently age 67 as of February 2015 there is no limit or penalty on how much a person can earn as stated by the Social Security Administration.

In 2021 that limit is increasing to 18960. You work and earn 28960 10000 over the 18960 limit during the year. 3 In the year you reach full retirement age.

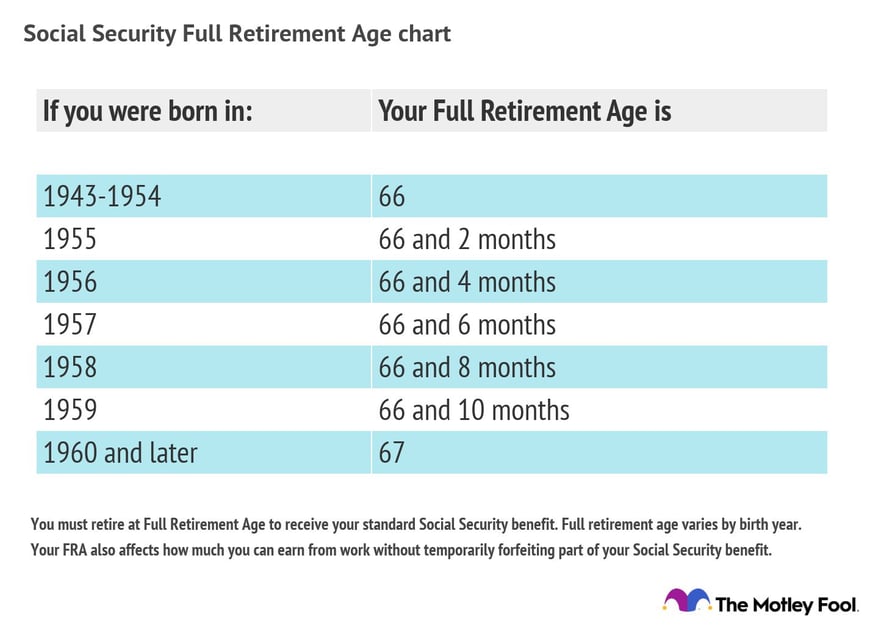

For security the Quick Calculator does not access your earnings record. Full retirement age is based on your year of birth. After that you ll lose 1 of annual.

If you work and earn 80000 you have exceeded the. After that you ll lose 1 of annual. In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240.

Social Security Quick Calculator. Until you reach full retirement age your benefits will be reduced by 1 for every 2 you earn in excess of 18240 for 2020 and 18960 for 2021. However there are income earning limits prior to full retirement age.

Once your income exceeds that point youll have 1 in Social Security withheld for every 2 you earn. For 2020 those who are younger than full retirement age throughout the year can earn up to 18240 per year without losing any of their benefits. Instead it will estimate your earnings based on information you provide.

If you have a combined income of more than 44000 you can expect to pay taxes on up to 85 of your Social Security benefits. Your Social Security benefits would be reduced by 5000 1 for every 2 you earned over the limit. The Social Security earnings limits are established each year by the SSA.

Your annual income from Social Security will be reduced to 5320 from the total 14000 because 8680 of your benefits will be withheld. In 2021 the cap is 142800 its adjusted annually to reflect historical wage trends. So benefit estimates made by the Quick Calculator are rough.

In 2021 the limit is 18950 for those reaching their full retirement age in 2022 or later. In the year you reach full retirement age your. For 2020 those who are younger than full retirement age throughout the year can earn up to 18240 per year without losing any of their benefits.

Total monthly income 317 Gross wages.

10 Steps To Make Social Security Easier

10 Steps To Make Social Security Easier

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png) Social Security Survivor Benefits For A Spouse

Social Security Survivor Benefits For A Spouse

50 How Much Can You Make And Still Draw Social Security Oz2h

50 How Much Can You Make And Still Draw Social Security Oz2h

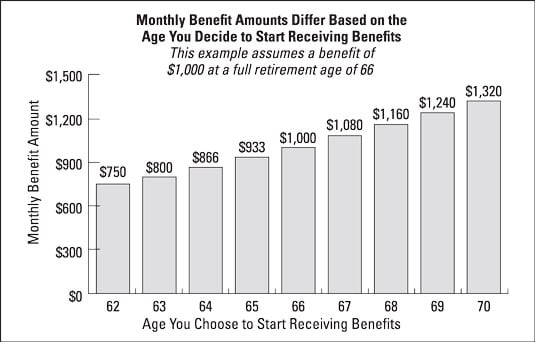

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

How Much Does Social Security Pay On Average To Retired Workers

How Much Does Social Security Pay On Average To Retired Workers

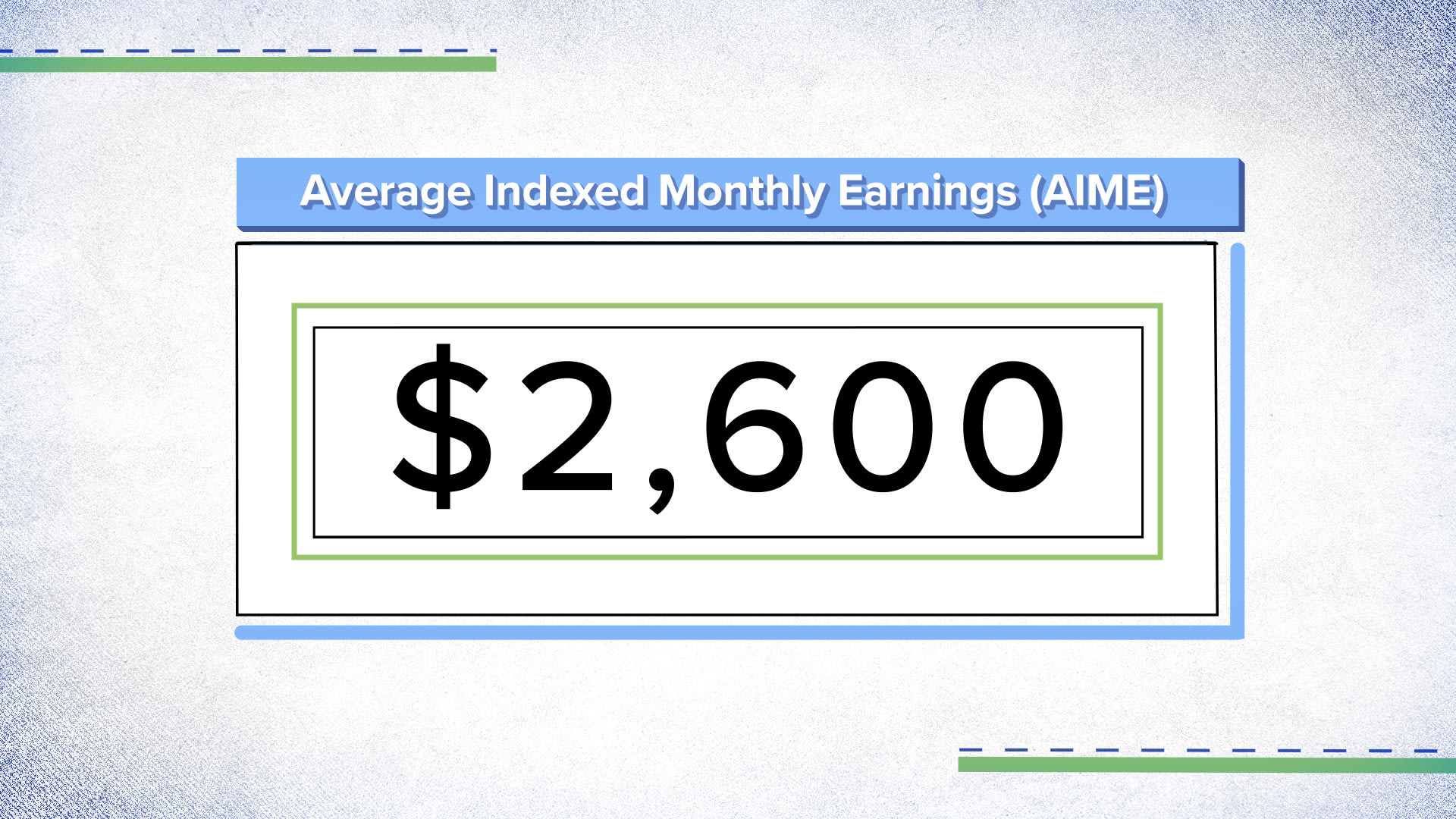

Social Security Calculator How Much Your Benefits Will Be In 2021

Social Security Calculator How Much Your Benefits Will Be In 2021

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

What Happens If You Work While Receiving Social Security Social Security Us News

What Happens If You Work While Receiving Social Security Social Security Us News

How Much Can You Make While Receiving Social Security

How Much Can You Make While Receiving Social Security

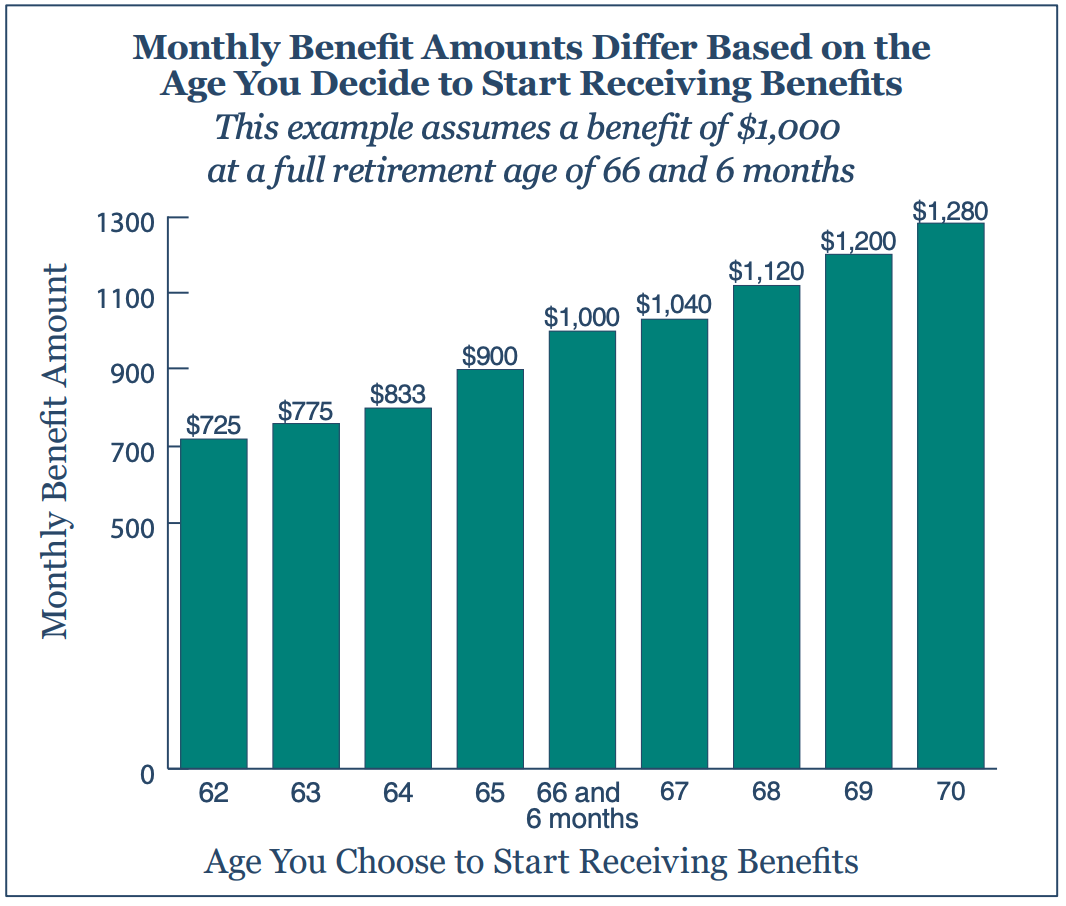

How To Estimate How Much Social Security You Ll Get Each Month Dummies

How To Estimate How Much Social Security You Ll Get Each Month Dummies

Https Www Post Journal Com Life 2017 04 Social Security And What You Can Expect

Comments

Post a Comment