New York City Income Tax Brackets

The city income tax rates vary from year to year. AND NYS taxable income is LESS than 65000.

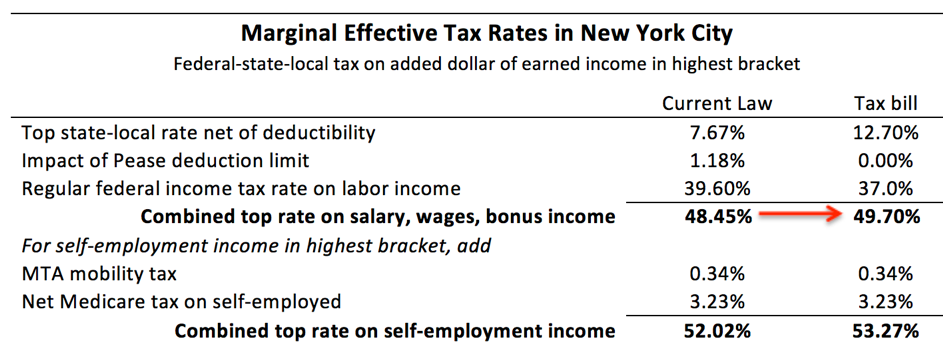

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

2021 New York Tax Tables with 2021 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/127810433-F-56a9384f3df78cf772a4e1fa.jpg)

New york city income tax brackets. New York City has four separate income tax brackets that range from 3078 to 3876. The citys tax rates range from 3078 of taxable income to 3876 for top earners. New York City or Yonkers Tax.

New York City has a separate city income tax that residents must pay in addition to the state income tax. General Corporation Tax Rates General Corporation Tax is computed by four different methods and is imposed at whichever method produces the largest amount of tax. New York State Tax.

New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. Quick Easy Purchase Process. New York City Income Tax Rates New York City has four tax brackets ranging from 3078 to 3876.

NYS tax rate schedule. The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. NYS adjusted gross income is MORE than 107650.

Entire net income base 885 of net income allocated to New York City. New York City collects its own income taxes in addition to those collected by the state. New York state income tax rate table for the 2020 - 2021 filing season has eight income tax brackets with NY tax rates of 4 45 525 59 609 641 685 and 882 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Rates kick in at different income levels depending on your filing status. OR Total Capital base 15 of business and investment capital allocated to New York City for. Ad Search To Do Your Taxes.

Part-year NYC resident tax. Where you fall within these brackets depends on your filing status and how much you earn annually. Your average tax rate is 222 and your marginal tax rate is 360This marginal tax rate means that your immediate additional income will be taxed at this rate.

Ad Search To Do Your Taxes. Get Results from 6 Engines at Once. NYC Income Tax Brackets.

The Department of Finance DOF administers business income and excise taxes. Full Refund Available up to 24 Hours Before Your Tour Date. Ad Hadromi Partners is one of the prominent law firms in Indonesia.

New Yorks income tax rates were last changed one year ago for tax year 2019 and the tax brackets were previously changed in 2016. AND NYS taxable income is 65000 or MORE. The tax rate youll pay depends on your income level and filing status and its based on your New York State taxable income.

Use the NYS tax computation. Ad Hadromi Partners is one of the prominent law firms in Indonesia. Compare the Best Tours and Attractions Now.

Ad Discover Everything New York City has to Offer. Below are the rates for New York City alone. If you make 55000 a year living in the region of New York USA you will be taxed 12187That means that your net pay will be 42813 per year or 3568 per month.

Each marginal rate only applies to earnings within the applicable marginal tax. What are the personal income tax rates for New York City. NYS adjusted gross income is 107650 or LESS.

DOF also assesses the value of all New York City properties collects property taxes and other property-related charges maintains property records administers exemption and abatements and collects unpaid property taxes and other property-related charges through annual lien sales. Get Results from 6 Engines at Once. What are the personal income tax rates for New York City.

There are no city-specific deductions but some tax credits specifically offset the New York City income tax. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

Https Www Empirecenter Org Wp Content Uploads 2018 04 Rdb Pit Ejm April 2018 Update Pdf

New York Income Tax Calculator Smartasset

New York Income Tax Calculator Smartasset

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Exploring Ny S Top Heavy Pit Base Empire Center For Public Policy

Average Income In New York City What Salary Puts You In The Top 50 Top 10 And Top 1 Sportofmoney Com

New York Taxes Layers Of Liability Cbcny

New York Taxes Layers Of Liability Cbcny

Immigrants In New York Their Legal Status Incomes And Taxes

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/127810433-F-56a9384f3df78cf772a4e1fa.jpg) New York City Income Tax Rates And Credits

New York City Income Tax Rates And Credits

Do States Like New York And California Really Have High Taxes Quora

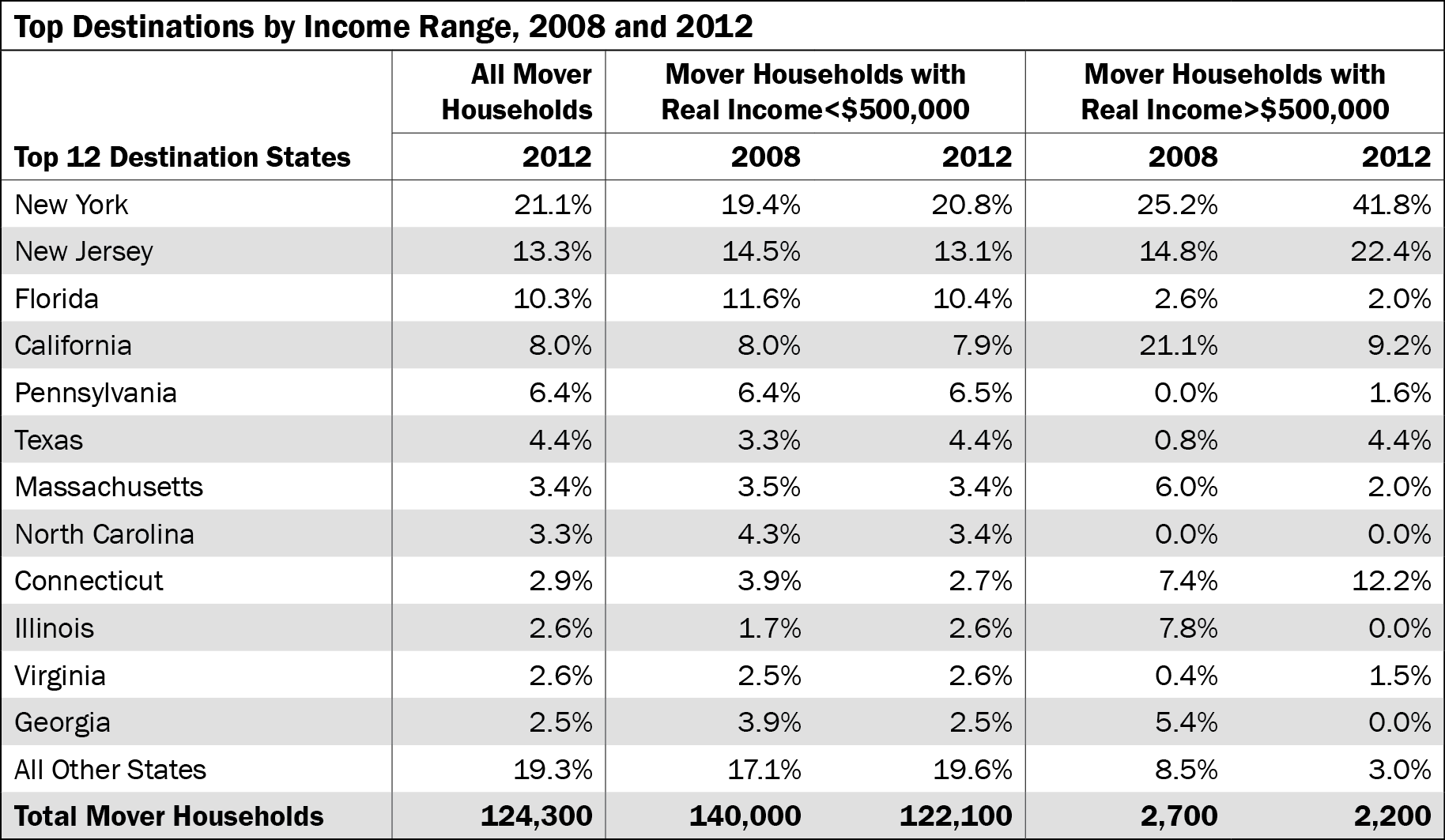

When New Yorkers Move Out Of New York City Where Do They Go New York City By The Numbers

When New Yorkers Move Out Of New York City Where Do They Go New York City By The Numbers

Albany Boosts Taxes On Wealthiest Wsj

Albany Boosts Taxes On Wealthiest Wsj

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Comments

Post a Comment