How Do You Earn Dividends On Stocks

The board of directors elected by the stockholders or owners meets and listens to managements recommendations about how much of the profit should be reinvested in growth. Option 2 is better because you get paid while you are the owner of a dividend-paying stock.

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

Thus another way to make money on stocks is by writing call and put options to receive a premium from the options buyer.

How do you earn dividends on stocks. Buy low and sell high. Stocks pay dividends monthly quarterly semi-annually and annually giving investors plenty of opportunity to earn predictable income. The call or put option can.

A dividend is paid per share of stock if you own 30 shares in a company and that company pays 2 in annual cash dividends you will receive 60 per year. There is another tool within this file that allows you to run scenarios based on how much annual income you want from dividends. But if the dividend does not increase over time the amount of money you can make is.

Basically there are two ways to make money from the stock market Capital appreciation and making money from dividends. You are not earning any money while you hold on to a stock that doesnt pay dividends. You can get a free 50 in your favorite stocks when.

Bonds are another type of investment that can pay dividends. If a stock has a yield of 5 you know that you would. Not every company pays dividends.

When it comes to capital appreciation most of the people know this method to make money from stocks. Receiving steady dividend income is one of the best ways to generate returns over the long term. Dividends are distinct from.

A portion of the remaining profit is then paid out to shareholders as dividends. Learn how covered calls can strengthen your position through choppy market conditions. What is dividend yield.

If a company is focused 100 on growth they are going to use all their earnings to continue to grow their business. However writing option contracts is risky. Dividend yields enable investors to quickly gauge how much they could earn in dividends by investing a certain amount of money in a stock.

With that being said there are many large companies that are focused on growth that pay a dividend. Youre less likely to get a dividend when you buy stock in a newer company because they often need to reinvest their profits to grow. 1 2.

The standard practice for the payment of dividends is a check that is mailed to stockholders a few days after the ex-dividend date which is the date on which the stock starts trading without the. There are two main ways to invest in dividend stocks. If your shares in the fund earned a profit the mutual fund company can choose to use that money to reinvest in the company pay down debt or give you a cut of the profit in the form of a dividend.

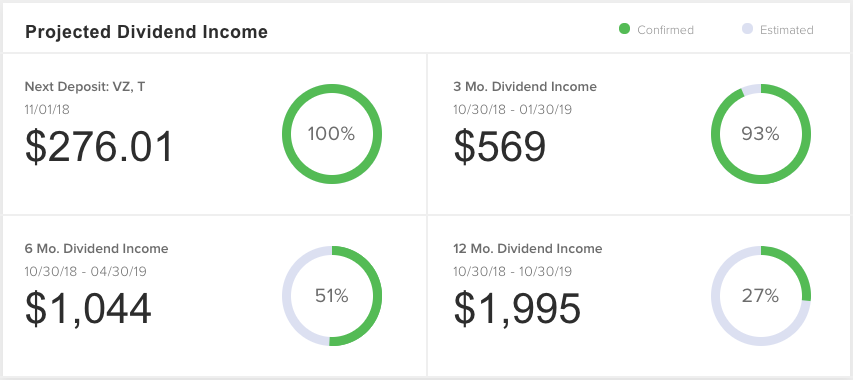

For example if you wanted to know how much money you would need to get 50000 in dividend income from a given stock all you need to do is plug in the stock ticker and 50000 desired income to get your answer. With Option 1 you are only hoping for the stock price to go up. Dividend income comes from owning dividend-paying stocks.

How do stock dividends work. For instance if a company pays a. The exact amount of money you will need to invest to create a 1000 per month dividend income depends on the dividend yield of the stocks.

Cash dividends are most common so well focus on those in this post. Purchase a good stock at a low valuation and wait until the price goes up. Through mutual funds such as index-funds or exchange-traded funds that hold dividend stocks or by purchasing individual dividend stocks.

The term dividend refers to cash payments typically paid quarterly received for owning shares of stock in a company he says. To make 1000 a month in dividends you need to invest between 342857 and 480000 with an average portfolio of 400000. Its the return on investment in terms of the dividends you receive for the money you invested.

In the US most dividends are cash dividends which are cash payments made on a per-share basis to investors. Dividends are usually paid out quarterly and can be paid in cash stock or property. Companies fund dividend payments when they earn a profit.

High Dividend Stocks Intelligent Income By Simply Safe Dividends

High Dividend Stocks Intelligent Income By Simply Safe Dividends

What Are Dividend Stocks Dividend Com Dividend Com

What Are Dividend Stocks Dividend Com Dividend Com

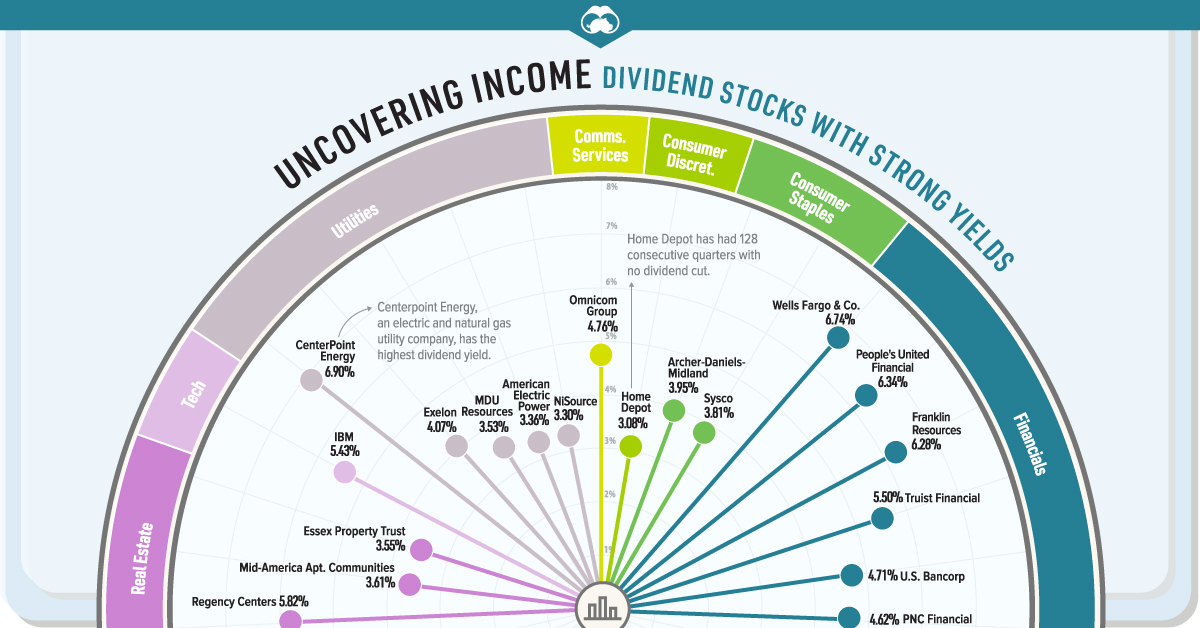

Uncovering Income Dividend Stocks With Strong Yields Visual Capitalist

Uncovering Income Dividend Stocks With Strong Yields Visual Capitalist

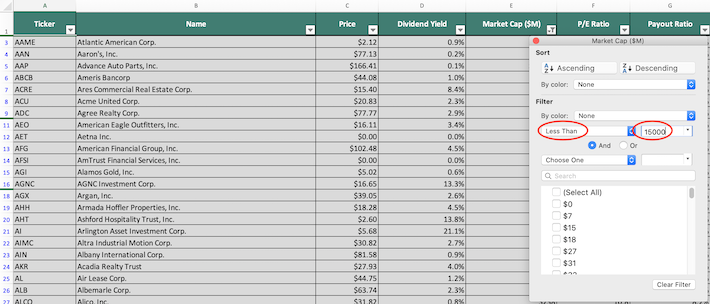

The Complete List Of Stocks That Pay Dividends In April Excel Download

The Complete List Of Stocks That Pay Dividends In April Excel Download

Dividend Dates Explained Ex Date Record Payment Dividend Com

Dividend Dates Explained Ex Date Record Payment Dividend Com

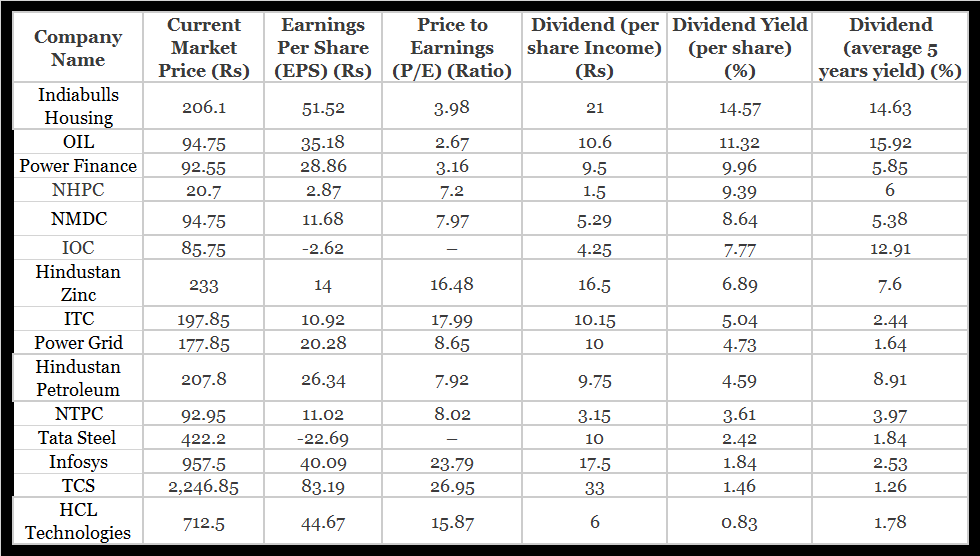

15 Highest Paying Dividend Stocks Of 2020

15 Highest Paying Dividend Stocks Of 2020

Cash Dividends Bonus Stocks Stock Dividends Rights Issues And Net Download Scientific Diagram

Cash Dividends Bonus Stocks Stock Dividends Rights Issues And Net Download Scientific Diagram

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png) How To Use The Dividend Capture Strategy

How To Use The Dividend Capture Strategy

Stocks That Pay Dividends Page 1 Line 17qq Com

Stocks That Pay Dividends Page 1 Line 17qq Com

What Are Dividend Stocks Dividend Com Dividend Com

What Are Dividend Stocks Dividend Com Dividend Com

An In Depth Guide To How Dividend Stocks Work Trade Options With Me

An In Depth Guide To How Dividend Stocks Work Trade Options With Me

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

How Often Are Dividends Paid On Stocks The Motley Fool

How Often Are Dividends Paid On Stocks The Motley Fool

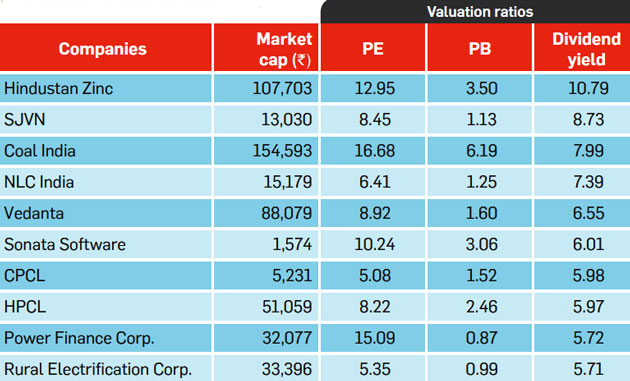

Stock Market How To Play The Dividend Yield Strategy In A Rising Stock Market

Stock Market How To Play The Dividend Yield Strategy In A Rising Stock Market

Comments

Post a Comment